The 2016 “budget package” approved by Ukraine’s Parliament in the end of December represents a step in the right direction, for it notably lowers the taxation of salaries and redistributes significant resources from the public sector to the private sector. However, it should be viewed as just a first step forward with broad reform agenda remaining in the budget-related sectors and beyond.

By Olena

Bilan

Chief Economist at Dragon Capital, a member of the Editorial Board of

VoxUkraine

The 2016

“budget package” approved by Ukraine’s Parliament in the end of December

represents a step in the right direction, for it notably lowers the taxation of

salaries and redistributes significant resources from the public sector to the

private sector. However, it should be viewed as just a first step forward with

broad reform agenda remaining in the budget-related sectors and beyond.

Key Changes to Tax Legislation

On December

24, the Verkhovna Rada approved a package of laws critical for

disbursement of the third IMF loan tranche of $1.7bn out of $17bn

Extended Fund Facility and related official financing of $2.3bn. The so called

“budget package” includes the 2016 budget bill with a deficit target of

3.7% of GDP, amendments to the tax code, and several other laws aimed at

launching structural reforms in budget-related sectors.

The most

important changes to tax legislation include:

- a reduction of the employer-paid social security contribution (SSC) rate to 22% from 41% on average;

- cancellation of the employee-paid SSC (3.6% before);

- a flat personal income tax rate of 18% (vs. 15%/20% before);

- cancellation of the special VAT regime for agricultural companies and concurrent reinstatement of grain export VAT refunds with a transition period in 2016;

- a reduction in gas extraction taxes;

- cancelation of 5-10% import surcharges;

- increases in fuel, tobacco and alcohol excise taxes of up to 13%, 40% and 50-100%, respectively;

- slightly tightened eligibility criteria for simplified taxation and a marginal increase in the respective tax rates

Table 1: Comparison

of Key Tax Rates

Notes: *15%

for incomes below the UAH 12,180 threshold (10 minimum salaries), 20% for

incomes above that threshold, half of minimum salary set at UAH 1,218/month is

not taxed for wages below 1.4*minimum salary; **half of minimum salary set at

UAH 1,378/month for 2016 is not taxable for wages below 1.4*minimum salary;

***average of 70+ different rates. Sources: Verkhovna Rada, Finance Ministry,

author estimate

Lower Salaries Taxation

In terms of

major tax rates, the new levels are close to the government’s initial proposal

of equalizing all rates at 20%. However, the new legislation achieved less than

what the government aimed at in terms of tax base expansion, in particular,

with respect to limiting tax evasion through the use of simplified taxation.

Still, approved tax changes and overall packages represent a step in the right

direction, particularly with respect to reducing the excessive taxation of

salaries, which stimulated widespread under-the-table pay, as well as with

concurrently broadening the tax base (though on a smaller scale than

necessary).

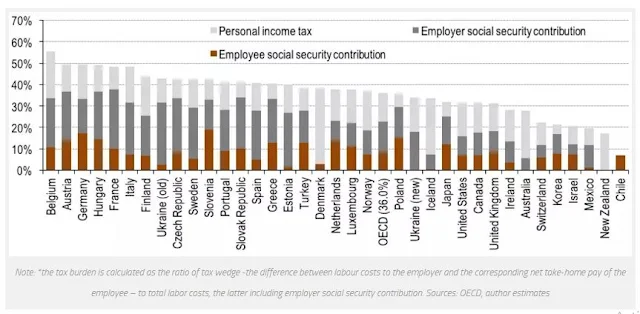

The Doing

Business survey ranks Ukraine among the top-5 countries with the heaviest labor

taxation burden on business globally, along with France, Belgium, China and

Italy. We estimate the aforementioned employer SSC cut and cancellation of the

employee SSC will reduce the tax burden on salaries (tax wedge under OECD

terminology) from 43% to 34% [1], making Ukraine more attractive in this

respect than the Czech Republic, Slovak Republic or Poland, not to mention the

developed EU states.

Figure 1: Tax

Burden on Salaries* in OECD Countries and Ukraine (2014)

As a result,

the overall tax burden on business will ease substantially. Using the Doing

Business methodology, the total tax rate paid by an average Ukrainian company

would drop by a third (or 18pp) to 34% of commercial profit [2], below the global average of 40.8% and

many CEE peers including Poland, Romania, Hungary and others. As a result,

Ukraine’s position in Doing Business’ paying taxes sub-ranking may improve by

50 places to 58th.

Figure 2: Tax

Burden on Business According to 2016 Doing Business (based on 2014 data; % of

commercial profit*)

Resources Reallocation

The lower SSC

rate will create around UAH 100bn (4.4% of GDP) shortfall in general government

revenues [3], assuming no positive effect from

legalization of salaries. As other changes to tax legislation approved by

Parliament will have only slight positive impact on the budget, on our

estimates; most of the revenue shortfall caused by SSC rate reduction is set to

be offset by introduced spending-side measures laying the foundation for deeper

structural reforms in the inefficient and corruption-prone spheres such as

social assistance, healthcare and education. Thus, the new legislation will

effectively reallocate some 3.0-4.0% of 2016 expected GDP from the public to

the private sector.

Such

reallocation will be supportive for Ukraine’s economy, as the public sector

usually uses economic resources less efficiently than the private sector, which

is especially true for countries with weak institutions. Companies seeing their

earnings increase thanks to lower taxation could use these additional resources

in several ways. They could increase employee salaries, thereby supporting

final consumption. They could de-shadow their business activity by legalizing

gray salaries, thus returning at least a portion of the additional resources to

the state budget. For loss-making companies (a majority in Ukraine these days),

a lower tax burden would help them continue in a tough economic environment

without severe cost and/or production cuts. At the same time, profitable

companies would be able to reinvest in more efficient production, though some

may also decide to stash additional profits abroad.

Despite some

potential for salary legalization, this process is likely to be extended in

time given the low level of trust in public institutions in Ukraine and no new

penalties having been introduced for salaries paid under the table. Thus, the

bulk of reallocated resources will likely stay within the private sector, supporting

economic activity. It is hard to estimate how exactly these resources will be

used by private companies. Given the difficult economic conditions and

deteriorating external environment, most local businesses hardly have

additional investment in their near-term plans. Thus, in the short term, the

reallocation of resources will support economic activity mostly by enabling

local business to avoid severe cost cuts (although the capital account may also

deteriorate marginally as some companies may prefer to keep more funds abroad),

while in the medium-term perspective it should be conducive to higher

investment and consumption.

Eminent Step Forward, But Far From Sufficient

While the 2016

“budget package” carries positive implications for the Ukrainian economy, it

should be viewed as only a first step forward. Deep structural reforms in

budget-related sectors are needed to improve the efficiency of budget spending.

The reform agenda includes, but is not limited to, the introduction of

means-tested social assistance, overhaul of the healthcare and education

sectors, and reform of the unsustainable pension system. Without these

measures, any further reduction in the tax burden can only come only at the

cost of a wider fiscal deficit and macroeconomic instability.

There is much

more to be done elsewhere. While the SSC rate cut will boost Ukraine’s position

in one of Doing Business’s nine components, it will change the business

environment only marginally, improving Ukraine’s overall ranking (83rd out

of 189 countries in the latest 2016 survey) by a mere 4 spots. The tax burden

is a far smaller problem for local and international businesses compared to

corruption and weak protection of property rights. Indeed, measuring the

distance to the best performer in the 2016 Doing Business survey (so called

distance to frontier), Ukraine fares well on the ease of starting a business

(94% to frontier), getting credit (75%) and paying taxes (71%) but performs

poorly when it comes to resolving insolvency or protecting minority investors.

Thus, even with the most liberal tax system in the world Ukraine would hardly

manage to attract significant investment without making progress in other

critical areas such as contract enforcement, corporate governance, and access

to electricity.

Figure 3:

Ukraine’s Distance to Frontier (DTF)* in Doing Business Categories (2014)

The author doesn't work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations

Notes

[1] The calculation for Ukraine is based on

an average gross salary of UAH 4,000 per month. Under new tax rates, total

labor costs equal to UAH 4,880 = UAH 4,000+22% employer SSC *UAH 4,000. Net

take-home pay equals to UAH 3,220 = UAH 4,000 – 18% personal income tax) *UAH

4,000-1.5% war tax* UAH 4,000-0% employee SSC*UAH 4,000. Tax wedge equals to

UAH 1,660=UAH 4,880-UAH 3,220. Tax burden equals to 34%=UAH 1,660/UAH 4,880.

[2] According to the World Bank, in 2014

statutory employer SSC rate for an average Ukrainian company stood at 38.2% and

represented 43% of that company’s commercial profit http://www.doingbusiness.org/data/exploreeconomies/ukraine#paying-taxes.New employer SSC rate of 22% will thus translate into 24.8% of commercial

profit (22*43/38.2). With other taxes unchanged and representing 9.1% of

commercial profit (employee SSC and personal income tax are not included in

calculation), tax burden on business declines from 52% to 34%.

[3] According to Finance Ministry

calculations, 1 percentage point cut in SSC rate reduces budget revenues by UAH

5.0bn. http://www.minfin.gov.ua/uploads/redactor/files/567038854c68e.pdf.

According to Social Policy Minister Rozenko, approved cut in SSC rate to 22%

will cause UAH 100bn drop in revenues. http://economics.unian.ua/finance/1226391-rozenko-zapevnyae-scho-vidilenih-groshey-vistachit-dlya-stabilnoji-roboti-pensiynogo-fondu.html

Source: VoxUkraine