By Manish Vaid, Junior Fellow, Observer Research Foundation

By Manish Vaid

Junior Fellow, Observer Research Foundation

Image Attribute: Oil Pump Jack Image Source: Paul Lowry, Flickr, Creative Commons

Introduction

After the 2016 Algiers Accord, all eyes are on Vienna where the 14-member OPEC will meet on November 30, 2016, to finalize and formalize the agenda to cut oil production, the first one since the financial crisis of 2008. At the Algiers meeting in September, the OPEC agreed to reduce output from 33.24 million barrels per day (mbpd) to a level between 32.5 million and 33 million barrels per day (mbpd) [1]. Accordingly, quotas for each of the member countries are expected to be decided in the Vienna at the 171st meeting of OPEC.

The oil production cuts attempt to tackle the economic crisis being faced by the OPEC countries owing to a persistent fall in oil prices since mid-June 2016. Saudi Arabia, for its part, hopes to leverage its efforts to jump-start economic reform process under its ‘Vision 2030’ plan.

The news of production cuts from some of the biggest oil producers brought cheers to the markets, propelling the prices upwards by more than 6 percent [2]. Subsequently, on October 27, 2016, oil prices recorded a 15-month high with Brent crude and U.S. West Texas Intermediate (WTI) at $50.47 and $49.72 respectively.[3] But the very next day, given the uncertainties around OPEC’s ability to sustain production cuts, both Brent and WTI registered a fall to $50.39 and 49.67 a barrel respectively.

Given OPEC’s past record of quota violations, uncertainty regarding the group’s willingness to carry through with the cuts is expected. This skepticism prevalent in the oil market could be reflected during the Vienna meet which risks falling just short of a deal, thus aggravating the perception of an OPEC with increasingly diminishing relevance.

The zero-sum game continues

In its war with U.S. shale oil producers for grabbing market share, OPEC led by Saudi Arabia, tried its best to push down oil prices by maintaining oil production levels. It succeeded to an extent, but this also affected several high-cost rival producers in OPEC as well as non-OPEC countries.

As Saudi Arabia has begun to feel the pinch of low oil prices, it has asked other members of the OPEC to support its bid to cut oil production to drive up oil prices. Saudi Arabia believes that this measure will be most beneficial in reforming its oil-dependent economy.

The Algiers Accord has allowed exemptions to Iran, Nigeria and Libya. Iraq too wished an exemption from production cuts to recover from losses due to war and sanctions. Iran, for instance, has already taken the lead by increasing its oil output by 210,000 barrels a day to 3.92 mbpd in October, its biggest gain since sanctions were lifted in January 2016.[4] Iraq too has started to attract investors with planned new production-sharing contracts and better returns.[5] These desperate moves by important OPEC member countries, which have sought exemptions could thwart the deal once again.

Importantly, this would be in addition to the faceoff between rivals Iran and Saudi Arabia on this issue. Saudi Arabia has raised its production to 12 mbpd, thus threatening to bring oil prices further down after Iran refused to limit its supply. The disagreement continues, even though Saudi Energy Minister, Khalid al-Falih, gave his consent on allowing Iran, along with Nigeria and Libya, to produce at maximum levels.[6] This erratic showdown could have an impact on the Vienna deliberation, thus putting the brake on any oil price recovery.

Moreover, it will be difficult for OPEC to drain the ocean of surplus oil already pumped from the ground and it will need countries outside the organization, such as Russia, to end the oil glut.[7] Given the squeezing oil demand, it remains to be seen if OPEC combined with non-OPEC countries can manage to together cut supply sufficiently to bring down unsustainable levels of inventories.

The fall in oil prices since mid-June 2014 has witnessed a simultaneous rapid rise in global oil inventories.The total oil production outpaced the global oil demand albeit at a reduced pace compared to last year (see Figure 1). The wide Contango structure of the market is guilty of providing financial incentives to keep producing large volumes of oil storage.[8]

Figure 1: Oil supply/demand balance, mb/d

Source: OPEC Secretariat

Compulsions beyond the game

Beyond the game of grabbing more market share, being played by Saudi Arabia, Iran, and the U.S., OPEC has a chequered past of quota violations, given individual political and economic reasons. These could once again play spoilsport.

Venezuela, for instance, could too join the countries which has sought exemptions from oil production cuts as any cuts or even freeze of oil production by this country could hamper its export revenues, which is 95 percent from the oil itself. The Bolivarian Republic is currently in complete economic mayhem [9]. Its GDP is projected to shrink by 10 percent in 2016. It's crude exports to the U.S. have already plummeted by 23 per cent along with sharp falls in exports to other countries as well. Under-investment, payment delays to suppliers and insufficient diluents to make exportable crude blends are reasons behind the dismal economic situation being faced by Venezuela. These factors are keeping Venezuela in a catch-22 situation as well evident from their indecisiveness about production cuts as well.

Historically, OPEC has used both pricing and production controls by establishing official posted price for their oil, setting production quotas for individual member countries and increasing or reducing overall production by its members [10]. But the compliance with production quotas, established in 1986, has been erratic due to lack of a solid implementation mechanism.

In a low oil price environment, countries relying heavily on oil revenues may need more output to sustain and hence may tend to violate quota. The case-in-point is Angola, where during the falling oil price environment of mid-2008, it started to attract oil and gas investors, in effect disregarding production quotas. In the past, Iran and Venezuela too opted against production cuts while pushing OPEC to do this job, primarily due to falling production and limited foreign investments. These instances are a classic case of the resource curse paradox of the oil and gas industry, wherein at high oil prices, oil-rich countries prosper and overreliance on oil sector leaves the same countries in a perilous situation, in case the oil prices fall.

These factors inherent to the oil and gas sector aggravate the vulnerability amongst OPEC countries. Thus, the decision by OPEC to abandon production quotas in favor of market-share strategy in November 2014 and its recent decision to again limit production have once again put in question the market effectiveness of OPEC.

The story so far

Given the cyclical nature of oil and gas industry, OPEC was established to provide stability in the market as enshrined in its mission:

“to coordinate and unify the petroleum policies of Member Countries and ensure the stabilization of oil markets in order to securean efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital to those investing in thepetroleum industry.” [11]

Yet, despite these objectives and controlling 72 per cent of world’s crude oil reserves (see Table1), OPEC’s ability to control the prices have remained uncertain. It has been argued that the U.S. shale oil companies, besides reducing their break-even cost, have evolved to respond to the changes in oil prices [12] better than OPEC.

Table 1: OPEC membership and its proven oil reserves (in ‘000 million tons)

Source: OPEC, BP Statistics

Over a 20-month period, oil prices moved up from $53.68 a barrel in January 2007 to 113.02 a barrel in August 2008, while peaking to $147 a barrel in July, thereafter coming down sharply to $98.13 a barrel in September 2008. A further fall in oil prices to $40.35 a barrel in December 2008 was recorded.

During that period the fall in oil prices was mainly due to collapse in oil demand following the negative developments in the global financial markets. Acting in conjunction with the oil bubble of 2007 and 2008, are fundamental factors such as increasing difficulty in finding oil and the rapid growth of emerging economies like China. All these factors together have had debilitating consequences for the price of oil. This was a period where it was believed that the world was rapidly moving towards scarce and costly oil. Subsequently, because of a sharp fall in the oil prices, OPEC began cutting oil production to arrest further fall in oil prices.

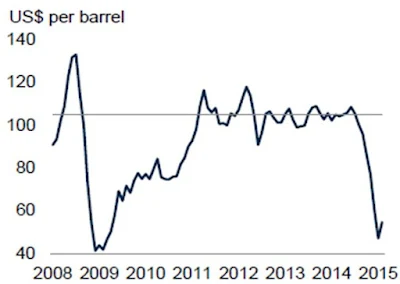

Over a prolonged period of approximately 64 months from April 2009 to July 2014oil prices remained above $100 a barrel for 42 months, averaging $97.89 a barrel [15]. Until the crude oil prices started to fall since June 2014 (Figure 2).

After a stable phase of four years, oil prices started falling from July 2014 and continued the rout over 28 months till October 2016. Oil prices moved down from $106.64 a barrel in July 2014 to $46.69 a barrel in September 2016 and hovering around $50 during October 2016, while touching a low of $30.75 a barrel in January 2016.[16]

Figure 2: Oil prices: recent developments

Source: World Bank [17]

Note: Monthly average of WTI, Dubai, and Brent oil prices. Horizontal line denotes $105 per barrel, the average for January 2011-June 2014.

From year 2000 up until mid-2014, oil went through a commodity super-cycle with prices over $100 a barrel. OPEC member countries enjoyed this cycle, which led to doubling of their petroleum exports from $611 billion in 2009 to $1.21 trillion in 2013.[18] High prices during this period were intensified by geopolitical tensions in countries like Syria, Sudan, Yemen, Nigeria, Iran and Iraq. However, easing of these tensions in 2014 led to the end of this oil super-cycle and resulting in a drastic fall in oil prices.

On November 27, 2014, at OPEC’s 166th meeting, a unanimous decision was taken to maintain collective production level at 30 mbpd, instead of implementing production cuts to stop oil prices from falling, as has been the norm.[19] The OPEC was keenly observing the U.S.’s shale oil production and worried that a sharp cut in oil production would incentivize the shale oil production helping it to grab the market share.

Further, the OPEC thought it would gain the market share if it kept oil production levels at a high of 30 mbpd and thus squeeze high-cost rival producers. While impacting shale oil production of the U.S. adversely, it also helped individual OPEC countries, which otherwise were afraid to cut oil production fearing an impact on their market share and oil revenue.

Thereafter, OPEC member countries met several times to build a consensus regarding their oil output strategy but failed to do so until they met again in Algiers in September 2016. In this meeting, they agreed to limit production for the first time, which is expected to be formalized in the November 30 meeting.

Saudi Arabia’s evolving oil policy

Saudi Arabia’s oil policy [20] has gone through three distinct phases between 2011 until now. In its first phase between 2011 and 2013, Saudi Arabia increased its oil output as a response to supply disruption. But this effort was not enough to compensate supply outages and the U.S. shale oil production managed to plug this gap.

The market imbalance of plummeting oil prices ending 2014 marked the beginning of the second phase of Saudi’s oil policy. Consequently, instead of putting breaks on its oil production, it prioritizes to capture market share to high cost and inefficient producers, including shale oil companies of the U.S. without engaging OPEC or non-OPEC countries. In the third phase emerging from Algiers Accord, Saudi Arabia once again moved towards cooperation amongst OPEC countries and shifted its policy from pursuing a market share strategy to production cuts’ strategy (Figure 3).

The last two phases were contradictory to the practices OPEC’s rebalancing the markets in response to price fluctuation, which was largely shaped towards meeting Saudi’s interests. In such attempt, Saudi Arabia misjudged the resilience of the U.S. shale oil companies’ consequent to the efficiency gains advantages in fracking the shale rocks. Henceforth, these two phases confused the market more making its response ineffective to deal with falling oil prices.

Figure 3: Saudi Oil Output, thousand b/d [21]

Source: Energy Aspects and University of Oxford

This has cast doubt on the decision of a meaningful production cut in the upcoming Vienna meet unless OPEC countries visualize the benefits of doing this eventually. In that case, Saudi Arabia could take a call and may want to go alone notwithstanding the cost which might bear for its decision. But with many OPEC countries not willing to cede their future output growth, especially, Iran could compel Saudi Arabia to think more than once for bearing the cost of production cuts.

Thus, Saudi Arabia’s existing oil policy is largely influenced and impacted by its visible acceptance of the supremacy of the U.S. shale, wherein the latter rests happily over the expectation of rising crude oil prices in case of production cuts. While Saudi Arabia succeeded to an extent in forcing shale oil companies to trim their CapEx, it was the latter which finally emerged a winner in this war, as they withstood the pressure been imposed on them to cut their shale oil production by incorporating operational efficiency measures.

Figure 4: U.S. Crude Oil Output, y/y change, thousand barrels per day [22]

Source: Energy Information Administration

However, a contrarian perspective states that Saudi Arabia’s policy shift is a part of its own articulated strategy to reform the country by increasing its non-oil revenue under ‘Saudi Vision 2030’.

To build the institutional capacity and capabilities needed to achieve this vision, the ‘National Transformation Program 2020 (NTP) was launched. Under Vision 2030, Saudi Arabia aspires to decrease its dependence on oil and embrace the non-oil private sector. Though, oil export constituting the main source of government revenue and the non-oil private sector’s continued dependence on government spending could make the successful implementation of this scheme a challenging affair. Saudi Arabia’s economy also has been hit hard with the falling oil prices as reflected by its stock market index (Figure 5).

Figure 5: Saudi Stock Market Index [23]

Source: Jadwa Investments

Climate change shaping a new world order

The role of setting targets for emission reductions has also become one of the major factors compelling energy transition by energy guzzlers like China and India, which are now moving towards cleaner fuels such as natural gas and renewables. These factors alone signal the beginning of an end of oil era and expected to shape a new world order, wherein the Middle East is said to be gearing up to such transformation. In the wake of apprehensions about the future of their export market, which has started to fade away has prompted many including Saudi Arabia to diversify their economies in several ways.

The diversification plans of Saudi Arabia, for instance, have been reflected in a series of documents starting from its Intended Nationally Determined Contribution (INDC) to Vision 2030. Under INDC, Saudi Arabia has planned to offer conditional emissions cuts of up to 130Mt CO2e (metric tons of carbon dioxide equivalent) by 2030, with an objective of locking in high-GHG infrastructure.[24] But being an oil economy, its plan for deploying renewable power and energy efficiency measures largely depends on oil revenues which make up 90 percent of its GDP.

Unveiled by its Deputy Prime Minister, Mohammad bin Salman Al Saud, Saudi Vision 2030 also speaks about long-term plan to diversify its economy away from dependence on oil revenues. The NTP, which was developed to help fulfill this vision, has set specified energy sector targets. This includes increasing the share of renewable energy generation, thereby increasing its share in total energy consumption; increasing dry gas production capacity and increasing the share of the pharmaceutical sector in non-oil GDP (Table 2).

Table 2: 2020 energy sector targets in the NTP [24]

Source: Vision 2030 Kingdom of Saudi Arabia; Energy Aspects

High oil prices needed for reforms

But to push its reforms on a sustained basis, Saudi Arabia needs oil prices to move up and hence has once again changed its oil policy to favor production cuts. This will help a successful initial public offering (IPO) launch, scheduled in 2018. As advocated by Saudi Aramco’s board member, AndrewGould, “An oil price of $50-$60 a barrel should be “sufficient” to develop enough oil production to keep the market well supplied in the coming years.” [25]

While Prince Mohammad is expecting to raise at least $2 trillion from selling Saudi Aramco’s five per cent share, Saudi Arabia wants higher oil prices to improve its valuation further with a set range of $50-$60 a barrel. Therefore, it will now hinge on Vienna’s November 30 meeting where Saudi Arabia would act in its interest by bringing other OPEC countries to agree on production freeze thereby reaching the targeted price level by 2018.

In all these efforts, the International Monetary Fund has praised Saudi Arabia’s economic reform plans as a step towards the far-reaching transformation of its economy. However, Vision 2030 is hugely dependent on the successful IPO of Saudi Aramco, the revenues of which will be instrumental in financing the Kingdom’s economic transformation. Hence this country is under pressure from lower crude oil prices.

Thus, it would again present a dilemma to OPEC and Saudi Arabia to have a consensus on production cuts and help prices rise. This, though, could help in achieving a better valuation of Saudi Aramco’s disinvestment plans and support Saudi Arabia’s move towards diversifying its economy. However, given the past trajectory of economic and political compulsions of individual OPEC member countries in settling to their production quotas alone might turn out to be a challenging one for Saudi Arabia.

This might prompt Saudi Arabia to bear even the highest cost of the deal to gear up for the beginning of the end of an oil era amid the very real threats of climate change. Saudi Arabia would do well regardless of what the long-term scenario is, to fix the deal for itself if it all is serious about transforming its economy.

Further, resetting of ties with its partners and going beyond just a buyer-seller relationship in oil trade would help it in its objective of diversifying the portfolio both in oil trade as well as well as strengthening relationships built upon wider trading platform.

For instance, in its attempt to renew ties with India, Saudi Arabia is now looking at mutual investments across several trade portfolios, including partnering for the International Solar Alliance. Further, India has offered Saudi Aramco a stake in India’s biggest oil refinery and petrochemicals project, proposed in coastal Maharashtra at an estimated cost of INR 1.5 trillion [26] to widen Saudi Arabia’s involvement in its oil and gas value chain.

Thus, notwithstanding the visible challenges and the obvious troubles which Saudi Arabia would have to incur in fixing the deal, the long-term outlook for Saudi Arabia’s economy looks brighter and promising if structured and implemented well.

About the Author:

Manish Vaid (TR RID: R-4485-2016) is Junior Fellow with the Observer Research Foundation, having research interests in energy policy and geopolitics.

Disclaimer: This paper was written before the OPEC's Vienna meeting. Views expressed are personal.

Cite This Article:

Vaid, M. "The Vienna Deal: A Crude Conundrum?" IndraStra Global Vol. 02, Issue No: 11 (2016) 0068, http://www.indrastra.com/2016/11/PAPER-Vienna-Deal-Crude-Conundrum-002-11-2016-0068.html | ISSN 2381-3652

References:

[1] Kallmeyer, Barbara. ‘OPEC has a terrible record adhering to quotas, oil analysts say’, Market Watch, September 29, 2016. Available athttp://www.marketwatch.com/story/opec-has-a-terrible-record-adhering-to-quotas-oil-analysts-say-2016-09-29. Accessed on November 8, 2016.

[2] Sheppard, David, AnjiliRaval and Neil Hume. “Opec agrees on oil output cut at Algiers meeting”, Financial Times, September 29, 2016. Available at https://www.ft.com/content/e781ddcc-8565-11e6-8897-2359a58ac7a5, accessed on November 8, 2016.

[3] Lou, Ethan. “Oil ends up, OPEC cut commitments assuage lingering doubts”, The Globe and Mail, October 27, 2016. Available at http://www.theglobeandmail.com/report-on-business/international-business/brent-crude-rises-above-50-as-us-inventory-drop-balances-opec-doubts/article32542319/, accessed on November 8, 2016.

[4] Smith, Grant. “Iran Tells OPEC It Raised Supply by Most Since Sanctions” Bloomberg, November 11, 2016. Available at http://www.bloomberg.com/news/articles/2016-11-11/iran-tells-opec-it-boosted-output-by-most-since-sanctions-ended-ivdp58a5, accessed on November 11, 2016.

[5] Zhdannikov, Dmitry, Ahmed Rasheed and Ahmad Ghaddar. “Iraq lures investors to boost its oil output as OPEC debates cuts”, Dailymail, October 26, 2016. Available at http://www.dailymail.co.uk/wires/reuters/article-3875018/Iraq-lures-investors-boost-oil-output-OPEC-debates-cuts.html, accessed on November 11, 2016.

[6] DiChristopher, Tom. “OPEC deal shows Saudi oil strategy has backfired, says John Kilduff”, CNBC, September 28, 2016. Available at http://www.cnbc.com/2016/09/28/opec-deal-shows-saudi-oil-strategy-has-backfired-says-john-kilduff.html, accessed on November 10, 2016.

[7] Smith, Grant. “OPEC May Need Help to End the Global Glut of Oil”, Bloomberg, October 27, 2016.

[8] OPEC. “OPEC Monthly Oil Market Report”, OPEC, November 11, 2016. Available at http://www.opec.org/opec_web/static_files_project/media/downloads/publications/MOMR%20November%202016.pdf, accessed on November 15, 2016

[9] Cifuentes, Erwin. “Venezuelan Crude Exports To U.S. Nosedive By 23 Percent”, Oil Price, November 3, 2016. Available at http://oilprice.com/Latest-Energy-News/World-News/Venezuelan-Crude-Exports-To-US-Nosedive-By-23-Percent.html, accessed on November 12, 2016.

[10] Hilyard, Joseph (2012). Petroleum Industry Structure. In The Oil & Gas Industry: A Nontechnical Guide (p.p.235, 236). U.S.A. (PennWell Corporation)

[11] OPEC. ‘Our Mission’, Organization of the Petroleum Exporting Countries. Available at http://www.opec.org/opec_web/en/about_us/23.htm.

[12] Ghouri, Salman. “OPEC Is Now Irrelevant – This Oil Price Plunge Is Different”, Oil Price, November 2, 2016. Available at http://oilprice.com/Energy/Energy-General/OPEC-Is-Now-Irrelevant-This-Oil-Price-Plunge-Is-Different.html, accessed on November 2, 2016.

[13] Organization of the Petroleum Exporting Countries. Available at http://www.opec.org/opec_web/en/about_us/25.htm

[14] BP Statistical Review of World Energy (2016). Available at https://www.bp.com/content/dam/bp/pdf/energy-economics/statistical-review-2016/bp-statistical-review-of-world-energy-2016-full-report.pdf.

[15] Ghouri. Op.cit,

[16] Ghouri. Op.cit

[17] Baffes, John et al. “The Great Plunge in Oil Prices: Causes, Consequences, and Policy Responses”, World Bank Group Working Paper, March 2015. Available at http://www.worldbank.org/content/dam/Worldbank/Research/PRN01_Mar2015_Oil_Prices.pdf, accessed on November 18, 2016

[18] Ramady Mohamed and Wael Mahdi (2015). A New Paradigm: Protecting Market Share? In OPEC in a Shale Oil World: Where to Next? (p.p. 4). Switzerland (Springer International Publishing).

[19] OPEC. “OPEC 166th Meeting concludes”. Available at http://www.opec.org/opec_web/en/press_room/2938.htm.

[20] Fattouh, Bassam and Amrita Sen. “OPEC Deal or No Deal? This is Not the Question”, The Oxford Institute for Energy Studies, October 2016.

[21] Fattouh, Bassam. “The Low-Cost OPEC Cycle: The Big Elephant in the Room”, The Oxford Institute for Energy Studies. Available at https://www.oxfordenergy.org/wpcms/wp-content/uploads/2016/10/The-Low-Cost-OPEC-Cycle-The-Big-Elephant-in-the-Room.pdf

[22] Fattouh. October 2016. Op.Cit.

[23] Fattouh, Bassam. “Saudi Arabia’s Vision 2030,Oil Policy and theEvolution of the Energy Sector”, The Oxford Institute for Energy Studies, July 2016. Available at https://www.oxfordenergy.org/wpcms/wp-content/uploads/2016/07/Saudi-Arabias-Vision-2030-Oil-Policy-and-the-Evolution-of-the-Energy-Sector.pdf.

[24] Fattouh, Bassam and Amrita Sen. “Saudi Arabia’s Vision 2030,Oil Policy and theEvolution of the Energy Sector”,

[25] Hume, Neil. “Oil price of $50-$60 is sufficient – Saudi Aramco board member”, Financial Times, October 18, 2016.

[26] PTI. “Mega refinery: India says ready to offer stake to Saudi Arabia”, The Economic Times, June 6, 2016. Available at http://economictimes.indiatimes.com/articleshow/52623425.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

![Figure 3: Saudi Oil Output, thousand b/d [21] Figure 3: Saudi Oil Output, thousand b/d [21]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi7GlzDbZWQLGa0o-Qz2YDglherzkTpgSd47uT-f5uTpH9vdSaRK4ZFym_A6E6Kfv4C-mbylg62tz16H71FalHvO1YeNYH5LvJSIcKAjUOKWR9PMh_Gbu0Xd7qPrveJhMOTmEqiYUEYlCbq/s400-rw/MV3.JPG)

![Figure 4: U.S. Crude Oil Output, y/y change, thousand barrels per day [22] Figure 4: U.S. Crude Oil Output, y/y change, thousand barrels per day [22]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiu4knv2dyrSXNLKJUkpVWQKpWv2PTeSHJbw7YHaeL9sGtpjenMXR_mywvf_gZaESuOzKzxJ5oTJmsVUCJM04CjqAjsaAqRSgceWyconrnaP9NEAusFg50790raHg8yT1yNFlv8VQQJqBtz/s400-rw/MV4.JPG)

![Figure 5: Saudi Stock Market Index [23] Figure 5: Saudi Stock Market Index [23]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi_q_aarTA9D7DYVScMC5zIwz6KOvytFvXujwYRcAZiexvUoaCdfaYswPTZHqufUok87ODHur8OpjksbZoinQK_Za6ZoXOaHjdzUiT3PAOv3TJQ2UZ9mynp92p1rFnwBNHXn4z5qZqcjm3B/s400-rw/MV5.JPG)

![Table 2: 2020 energy sector targets in the NTP [24] Table 2: 2020 energy sector targets in the NTP [24]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhnG90oR86xZUymErNohbPqhYPADYIhvt_vaSovWjJcAIh-g_F51BTwyIAVA6sXoHi4jB7V7cm_5OhsUSzs_A5eViNupqNVlWuTglFPnCkwuaSOwq07RxcOIJ9T0aCBnpCLQka8NZbPj7oP/s640-rw/TABLE1-MV.JPG)