On Jan 16, 2016, India's Prime Minister Narendra Modi unveiled his government’s action plan to help entrepreneurs, and asked them to play a transformative role in India’s development.

Abridged Report - Start-Up India Action Plan

To promote a culture

of entrepreneurship, the Government of India on Jan 16, 2015 announced a slew

of incentives including INR 10,000-crore (1 USD = INR 67.69 / INR 1 Cr = INR 1,00,00,000)

corpus for innovation-driven enterprises, a three-year break from paying income

tax on profits plus a Rs 500-crore per year credit guarantee mechanism, and on top of that, exemption from capital gains tax for start-ups. After a full day of discussions

at the launch of the ‘Start-up India’ programme attended by hundreds of young

entrepreneurs, India's Prime Minister Narendra Modi unveiled his government’s action

plan to help entrepreneurs, and asked them to play a transformative role in India’s

development.

Image Attribute: Release of Start-Up India Action Plan at Vigyan Bhavan, New Delhi

Source: iamwire.com

Compliance

Regime based on Self-Certification

Regulatory

formalities requiring compliance with various labor and environment laws are

time consuming and difficult in nature. Often, new and small firms are unaware

of nuances of the issues and can be subjected to intrusive action by regulatory

agencies.

In order to make

compliance for Start-ups friendly and flexible, simplifications are required in

the regulatory regime. Accordingly, the process of conducting inspections shall

be made more meaningful and simple. Start-ups shall be allowed to self-certify

compliance (through the Start-up mobile app) with 9 labour and environment laws.

In case of the

labour laws, no inspections will be conducted for a period of 3 years. Start-ups

may be inspected on receipt of credible and verifiable complaint of violation,

filed in writing and approved by at least one level senior to the inspecting

officer. In case of environment laws, Start-ups which fall under the ‘white

category’ (as defined by the Central Pollution Control Board (CPCB)) would be

able to self-certify compliance and only random checks would be carried out in

such cases.

The Creation of “Start-Up

India Hub”:

The “Start-up

India Hub” will be a key stakeholder in this ecosystem and will:

Work in a hub

and spoke model and collaborate with Central & State governments, Indian

and foreign VCs, angel networks, banks, incubators, legal partners,

consultants, universities and R&D institutions

Assist Start-ups

through their lifecycle with specific focus on important aspects like obtaining

financing, feasibility testing, business structuring advisory, and enhancement

of marketing skills, technology commercialization and management evaluation

Organize

mentorship programs in collaboration with government organizations, incubation

centers, educational institutions and private organizations who aspire to

foster innovation.

Fast Tracking of

Patent Filing and Intellectual Property Right Protection:

The scheme for Start-up

Intellectual Property Protection (SIPP) will encourage the filing of Patents,

Trademarks and Designs by innovative Start-ups. Various measures mentioned in

this regard include:

Fast Tracking of

Patent Filing

To this end, the

patent application of Startups shall be fast-tracked for examination and

disposal, so that they can realize the value of their IPRs at the earliest

possible.

Panel of

facilitators to assist in filing of IP applications:

For effective

implementation of the scheme, a panel of “facilitators” shall be empanelled by

the Controller General of Patents, Designs and Trademarks (CGPDTM), who shall

also regulate their conduct and functions. Facilitators will be responsible for

providing general advisory on different IPRs as also information on protecting

and promoting IPRs in other countries. They shall also provide assistance in

filing and disposal of the IP applications related to patents, trademarks and

designs under relevant Acts, including appearing on behalf of Start-ups at

hearings and contesting opposition, if any, by other parties, till final disposal

of the IPR application.

Government to

bear facilitation cost:

Under this

scheme, the Central Government shall bear the entire fees of the facilitators

for any number of patents, trademarks or designs that a Start-up may file, and

the Start-ups shall bear the cost of only the statutory fees payable.

Rebate on filing

of application:

Start-ups shall

be provided an 80% rebate in filing of patents vis-a-vis other companies. This

will help them pare costs in the crucial formative years. The scheme is being

launched initially on a pilot basis for 1 year; based on the experience gained,

further steps shall be taken.

Relaxed Norms of

Public Procurement for Start-ups

At present,

effective April 1, 2015 Central Government, State Government and PSUs have to

mandatorily procure at least 20% from the Micro Small and Medium Enterprise

(MSME). In order to promote Start-ups, Government will exempt Start-ups (in the

manufacturing sector) from the criteria of “prior experience/ turnover” without

any relaxation in quality standards or technical parameters. The Start-ups will

also have to demonstrate requisite capability to execute the project as per the

requirements and should have their own manufacturing facility in India.

Providing

Funding Support through a Fund of Funds with a Corpus of INR 10,000 crore:

In order to

provide funding support to Start-ups, Government will set up a fund with an

initial corpus of INR 2,500 crore and a total corpus of INR 10,000 crore over a

period 4 years (i.e. INR 2,500 crore per year) . The Fund will be in the nature

of Fund of Funds, which means that it will not invest directly into Start-ups,

but shall participate in the capital of SEBI registered Venture Funds.

Key features of

the Fund of Funds are highlighted below:

- The Fund of Funds shall be managed by a Board with private professionals drawn from industry bodies, academia, and successful Start-ups

- Life Insurance Corporation (LIC) shall be a co-investor in the Fund of Funds

- The Fund of Funds shall contribute to a maximum of 50% of the stated daughter fund size. In order to be able to receive the contribution, the daughter fund should have already raised the balance 50% or more of the stated fund size as the case maybe. The Fund of Funds shall have representation on the governance structure/ board of the venture fund based on the contribution made.

- The Fund shall ensure support to a broad mix of sectors such as manufacturing, agriculture, health, education, etc.

Credit Guarantee

Fund for Start-ups:

In order to

overcome traditional Indian stigma associated with failure of Start-up

enterprises in general and to encourage experimentation among Start-up

entrepreneurs through disruptive business models, credit guarantee comfort

would help flow of Venture Debt from the formal Banking System. Debt funding to

Start-ups is also perceived as high risk area and to encourage Banks and other

Lenders to provide Venture Debts to Start-ups, Credit guarantee mechanism

through National Credit Guarantee Trust Company (NCGTC)/ SIDBI is being

envisaged with a budgetary Corpus of INR 500 crore per year for the next four

years.

Tax Exemption of

Capital Gains:

Exemption shall

be given to persons who have capital gains during the year, if they have

invested such capital gains in the Fund of Funds recognized by the Government.

This will

augment the funds available to various VCs/AIFs for investment in Start-ups.

In addition,

existing capital gain tax exemption for investment in newly formed

manufacturing MSMEs by individuals shall be extended to all Start-ups.

Currently, such an entity needs to purchase “new assets” with the capital gain

received to avail such an exemption. Investment in ‘computer or computer

software’ (as used in core business activity) shall also be considered as purchase

of ‘new assets’ in order to promote technology driven Start-ups.

Tax Exemption to

Start-ups for 3 years

With a view to

stimulate the development of Start-ups in India and provide them a competitive

platform, it is imperative that the profits of Start-up initiatives are

exempted from income-tax for a period of 3 years. This fiscal exemption shall

facilitate growth of business and meet the working capital requirements during

the initial years of operations. The exemption shall be available subject to

non-distribution of dividend by the Start-up.

Tax Exemption on

Investments above Fair Market Value

Under The Income

Tax Act, 1961, where a Start-up (company) receives any consideration for issue of

shares which exceeds the Fair Market Value (FMV) of such shares, such excess

consideration is taxable in the hands of recipient as Income from Other

Sources. In the context of Start-ups, where the idea is at a conceptualization

or development stage, it is often difficult to determine the FMV of such

shares. In majority of the cases, FMV is also significantly lower than the

value at which the capital investment is made. This results into the tax being

levied under section 56(2) (viib). Currently, investment by venture capital

funds in Start-ups is exempted from operations of this provision. The same

shall be extended to investment made by incubators in the Start-ups.

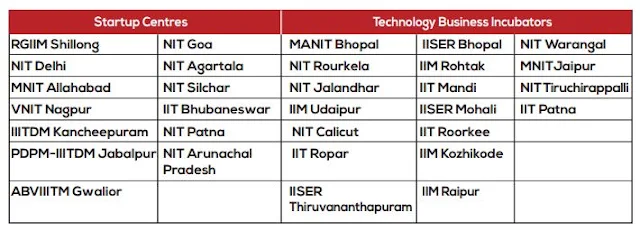

Building New

Start-Up Centers across the Country:

In order to

augment the incubation and R&D efforts in the country, the Government will

set up/ scale up 31 centres (to provide facilities for over 1,200 new Start-ups)

of innovation and entrepreneurship at national institutes, including:

Setting-up 13 Start-up

centres: Annual funding support of INR 50 Lakhs (shared 50:50 by DST and MHRD)

shall be provided for three years for encouraging student driven Start-ups from

the host institute.

Setting-up/

Scaling-up 18 Technology Business Incubators (TBIs) at NITs/IITs/IIMs etc. as

per funding model of DST with MHRD providing smooth approvals for TBI to have

separate society and built up space

Setting up of 7

New Research Parks Modeled on the Research Park Setup at IIT Madras:

The Government also

announced to set up 7 new Research Parks in institutes indicated below with an

initial investment of INR 100 crore each. The Research Parks shall be modeled

based on the Research Park setup at IIT Madras.

The guiding

principles behind the park include:

- Creating a collaborative environment between industry and academia through joint research projects and consulting assignments.

- Creating a self-sustaining and technologically fertile environment.

- Encouraging and enabling R&D activities and Start-ups that are aligned to potential needs of the industry.

- Providing world class infrastructure for R&D activities and incubation.

- Enabling development of high quality personnel and motivating professional growth for researchers in companies through part time Masters and PhD Programs.

Launch of Atal

Innovation Mission (AIM) with Self-Employment and Talent Utilization (SETU)

Program

The Atal

Innovation Mission (AIM) shall have two core functions:

Entrepreneurship

promotion

through Self-Employment and Talent Utilization (SETU), wherein innovators would

be supported and mentored to become successful entrepreneurs

- Establishment of sector specific Incubators including in PPP mode (refer #14 of this Action Plan)

- Establishment of 500 Tinkering Labs

- Pre-incubation training to potential entrepreneurs in various technology areas in collaboration with various academic institutions having expertise in the field

- Strengthening of incubation facilities in existing incubators and mentoring of Start-ups

- Seed funding to potentially successful and high growth Start-ups

Innovation

promotion:

to provide a platform where innovative ideas are generated. The main components

proposed to be undertaken as part of the mission include:

- Institution of Innovation Awards (3 per state/UT) and 3 National level awards

- Providing support to State Innovation Councils for awareness creation and organizing state level workshops/conferences

- Launch of Grand Innovation Challenge Awards for finding ultra-low cost solutions to India’s pressing and intractable problems.

At Last, but not

the least - Faster Exit for Start-ups:

Given the

innovative nature of Start-ups, a significant percentage of them fail to

succeed. In the event of a business failure, it is critical to reallocate

capital and resources to more productive avenues and accordingly a swift and

simple process has been proposed for Start-ups to wind-up operations. This will

promote entrepreneurs to experiment with new and innovative ideas, without

having the fear of facing a complex and long-drawn exit process where their

capital remain interminably stuck.

The Insolvency

and Bankruptcy Bill 2015 (“IBB”), tabled in the Lok Sabha (Lower House of

Indian Parliament) in December 2015 has provisions for the fast track and / or

voluntary closure of businesses. In terms of the IBB, Start-ups with simple

debt structures or those meeting such criteria as may be specified may be wound

up within a period of 90 days from making of an application for winding up on a

fast track basis. In such instances, an insolvency professional shall be

appointed for the Start-up, who shall be in charge of the company (the

promoters and management shall no longer run the company) for liquidating its

assets and paying its creditors within six months of such appointment.

On appointment

of the insolvency professional, the liquidator shall be responsible for the

swift closure of the business, sale of assets and repayment of creditors in

accordance with the distribution waterfall set out in the IBB. This process

will respect the concept of limited liability.

Source: Department of Industrial Policy and Promotions, Government of India ,

Download the Action Plan - LINK

Download the Action Plan - LINK