In recent years, the sharp increase in oil prices that began in 2001 and the two sharp declines that followed in 2008, due to the sub-prime mortgage crisis, and at the end of 2014–early 2015 have renewed interest in the effects of oil prices on the macro economy.

By Various Sources

In recent years,

the sharp increase in oil prices that began in 2001 and the three sharp declines

that followed in 2008, due to the sub-prime mortgage crisis, at the end of

2014–early 2015 and at early 2016 have renewed interest in the effects of oil prices on the macro

economy.

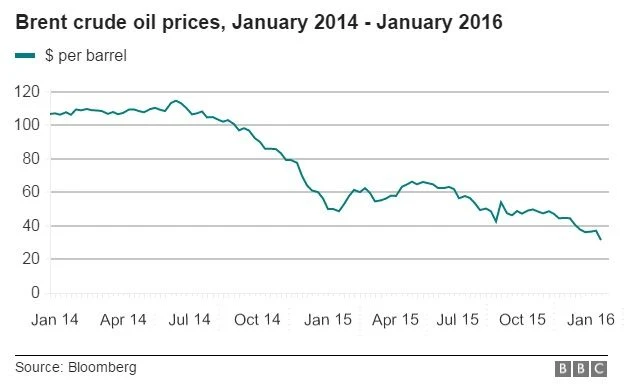

Chart Attribute: Brent Oil Crude Prices January 2014 - January 2016 / Source: Bloomberg

Most recently, the price of oil has more than halved in a period of

less than 5 months since September 2014. After nearly 5 years of stability, the

price of a barrel of Brent crude oil in Europe fell from over $100 per barrel

in September 2014, to below $30 per barrel in January 2016.

This raises

important questions to be answered. Firstly, are economies still elastic to oil

price movements, or have new, energy-related technologies and resources, like

renewables and shale gas, completely sheltered them from shocks? Secondly, if

economies are still elastic, are emerging and developed economies influenced to

the same degree?

We answered these

questions in a recent study (Taghizadeh-Hesary et al. 2015). In the study, we

analyzed the impact of oil price fluctuations on the gross domestic product

(GDP) growth rate and consumer price index (CPI) inflation in the three largest

crude oil consumers: the developed economies of the United States (US) and

Japan, and an emerging economy, the PRC. For the analysis, we selected a period

that includes the most recent financial crisis, the subprime mortgage crisis of

2008. This allowed us to compare the impacts in the period January 2000–July

2008 with the period following the crisis, August 2008–December 2013

Perspective

In an analysis published in 2009, Tom Therramus

pointed out that Black Monday fell into a broader pattern in which nearly every

stock market crash and recession of the preceding 50 years had occurred shortly

after a large and abrupt change in the price of oil. In the case of the 1987 Dow crash, it was

foreshadowed by a tumble in oil price that ensued in the wake of disputes within OPEC, which had come to a head in the previous year.

During the mid-1980s Saudi

Arabia grew increasingly frustrated with cheating on agreed oil production

quotas by other members of OPEC. In 1986 the

Saudis gave up honouring their own quota commitments to the cartel and the

price of oil plummeted.

Current falls

Between July 2014 and January 2016, oil price went below $30 per barrel. One of the steepest legs

of this decline was a 10% drop that occurred on Black Friday November 28, 2014 following a meeting of OPEC. The ostensible reason for this fall was that the

Saudis had refused to agree to production decreases being pushed by some OPEC

members, instead choosing to let the market play out for the time being.

What are the

impacts of oil price fluctuations on emerging and developed economies?

Empirical

results show that the impacts of oil price fluctuations on GDP growth rates for

developed oil importers (US and Japan) are much milder than for emerging

economies like People's Republic of China (PRC) (Taghizadeh-Hesary et al. 2015). The reasons for the difference

between the impacts on these two groups are high fuel substitution (higher use

of nuclear electric power, gas, and renewables), a declining population (in the

case of Japan), the shale gas revolution (for the US), greater strategic crude

oil stocks, and government-mandated energy efficiency targets in developed

economies compared to emerging economies, which make them more resistant to oil

shocks. In comparison, the impact of higher crude oil prices on PRC CPI

inflation is milder than in the two advanced economies. The reason for this is

that the higher economic growth rate in the PRC results in a larger forward

shift of aggregate supply, which prevents large increases in price levels after

oil price shocks.

Chart Attribute:

Annual statistical bulletin of the Organization of the Petroleum Exporting

Countries (OPEC) (2014).

By comparing the

results of these two subperiods—(i) January 2000–July 2008 and (ii) August

2008–December 2013—we can conclude that in the second subperiod, the impact of

oil price fluctuations on the US GDP growth rate and inflation rate was milder

than in the first subperiod because of the lower crude oil and aggregate demand

resulting from the recession in the economy. For Japan, the second subperiod

coincides with the Fukushima nuclear disaster that followed the massive

earthquake and tsunami in March 2011, which raised the dependency on oil

imports. Hence, the elasticity of GDP growth to oil price fluctuations rose

drastically. CPI elasticity declined, however, because of diminished

consumption due to uncertainty in the nation’s future after the disaster.

The

PRC’s GDP growth and inflation rate elasticities to oil price fluctuations were

almost constant in both subperiods. The main reason for this is the

appreciation of the yuan. Shortly after the sub-prime mortgage crisis, oil

prices started to increase sharply due to a mild recovery in the global economy

and the huge quantitative easing policies of the US and monetary authorities in

other countries. Simultaneously, the yuan appreciated compared to other

currencies, meaning that the price of crude oil in the PRC’s domestic market did

not fluctuate as much. The result was that crude oil prices had almost no

impact on the PRC’s economy (GDP and inflation) before and after the crisis.

Possible Scenario:

The mechanism by

which a fall in the price of oil could trigger a collapse in the stock market

lies in the financial devices used to fund oil exploration and exploitation

throughout the world and particularly in the United States. Modern oil

exploration is financed through a range of methods including issuance of shares

to increase capital, and raising debt through bonds and bank loans.

A shale oil well operating through hydraulic fracturing

can cost $9 million to get into production. When oil was hovering close to $100

per barrel, banks were more than willing to finance billions of dollars worth

of oil exploration projects. As far as banks were concerned these loans were

backed by tangible assets and considered low-risk. It was (almost) like

printing money. A price of $80 per barrel was seen as a floor in the

profitability of shale oil. This took an average break-even price of $70 per

barrel, plus a $10 margin for financing costs.

Today with oil

under $30, many producers lose $20 for every barrel produced and will

likely default on these loans, as outlined in last month’s “Falling Oil Price Slows US Fracking” article. This

loss will be passed to the banks that made the loans, as it happened with the

housing sector in 2008.

A telltale sign of

this is the recent 20% fall of high yield corporate bonds since this summer

that follow very closely the fall in crude oil prices. Many investors are

afraid of defaults in the high-yield market due to over-lending to the energy

sector and are indiscriminately selling off “junk bonds”. The downside of this

corporate bond selloff across the board is that less favourable financing

options will be available for other sectors, which in turn will spread the

slowdown to the rest of the economy.

Simple mathematics

reduces a credit-worthy company to bankruptcy — for example a company with

a market capitalization of $50 million owing $9 million suddenly becomes a bad

risk when its total value dives to $10 million thanks to the sudden switch from

profit to loss caused by the fall in the price of oil. A loss of profitability

causes a loss of share value — pension funds and investment houses have

seen billions wiped off the value of their investments in a matter of a few

months. The knock on effect of loss of value then permeates to the banking and

insurance sectors, causing the value of stock in those companies to fall.

Not all shale

oil exploitation was financed by loans and bonds. Derivatives have played a

part, too and many of the main players in the fracking business have their

prices set in futures contracts all the way into 2016. The holders of these

obligations to buy will be in serious trouble if the oil price does not turn

around by mid-2015 when many of these contracts fall due. The major Wall Street

banks hold a total of $3.9 trillion worth of commodities contract, the bulk of

which are based on oil and were written when oil seemed to be destined to

remain above $80 per barrel. If the price of oil stays below $80, America’s

biggest financial institutions will have to beg — once again — the Fed

(and the taxpayer) for help.

In addition to

those companies that drill for oil and those that finance them, there is a

large industrial sector supplying tools, chemicals and equipment to the oil

industry and the value of shares in those companies will tank as oil production

winds down. Major index component companies, such as GE and Halliburton will

see a loss of business and an inability to cover investments and loans in their

oil industry divisions. These financial shortfalls will affect dividend

payments or force them to sell otherwise profitable divisions to cover their

losses. When the value of index component companies falls, all index-linked

investment funds fall into losses. Managers of these funds usually sell off profitable

assets to meet their obligations. A sudden shortfall of cash caused by an

unexpected fall in the oil price could then trigger a sell off on Wall Street

in which case the price of all shares would drop under an urgent rush to sell.

Should energy loans

start to default, we may be looking at a snowballing effect in the order of the

2008 banking crisis with a caveat: low oil prices do help reduce the cost of

transportation and services and may be a blessing in disguise for the economy.

However this plays out, our FFT analysis illustrates that volatility is on the

cards. Fasten your seatbelts for a bumpy ride, and keep an eye open for

opportunities. As Warren Buffett once said: “Be fearful when others are greedy

and greedy when others are fearful.”

Reporting from ADB Blog, UN University Blog and EIA Press Release