Do international treaties influence investment decisions into developing countries? Can governments boost the attractiveness of their country to foreign investors by signing on to international trade and investment agreements?

By World Bank

Do international treaties influence

investment decisions into developing countries? Can governments boost the

attractiveness of their country to foreign investors by signing on to

international trade and investment agreements?

Image Attribute: An image of a

great amount of shipping containers at the Hong Kong Container Terminal./

Creative Commons

The survey and

subsequent analysis by Kenyon and Margalit (2012) shed light on these

questions.16 Respondents were first asked whether they had knowledge of the

international trade and investment agreements signed by the country in which

their largest investment is located. The majority of respondents (74 percent)

were unaware of any regional or bilateral trade agreements to which the host

country is a signatory. Of the 229 investors that answered this question, only

60 respondents (26 percent) had knowledge of participation in international

trade agreements by their largest host country. Interestingly, this awareness

varied across countries. Almost 60 percent of South African investors and 56

percent of Brazilian respondents claimed to be aware of the trade agreements

signed by their largest host country. By contrast, only 30 percent of Indian

and less than 6 percent of Korean respondents claimed to know whether their

main investment destination had a trade agreement.

More than half

(51 percent) of those with knowledge of trade agreements signed by the host

country said the latter actually had influence on their companies’ business

operations. When asked about the specific benefits derived from these

agreements, 30 percent mentioned the expansion of the size of the export market

and 23 percent said they contributed to a reduction in the costs of trade.

Access to raw materials (16 percent) and improved access to finance (13

percent) were also identified as important potential benefits of trade

agreements by the host country. Notably, no respondents selected the option of

the trade agreement including a chapter on investment and investor protection

as the main benefit. Almost 70 percent of respondents said there were no

potential disadvantages from membership in trade agreements.

A smaller

proportion (43 percent) of investors were aware of the host country’s record in

terms of BITs. Ninety percent of those who claimed to be aware of the BITs

signed by their host country were from Korea. To the follow-up question of

whether these treaties influenced their companies’ business operations, only 16

respondents (30 percent) gave an affirmative answer, citing, among other

potential benefits, greater safety and clarity in the investment process.

These results

suggest that while the host country’s participation in international trade and

investment treaties is not the most prominent factor influencing the choice of

an investment location by TNCs from emerging markets, it is taken into account

by a sizable share of foreign investors. To shed further light on the ways in

which membership in international economic agreements may influence the

attractiveness of a host country in the eyes of foreign investors, the survey

included an experimental question, in which executives were asked to assess and

rate four hypothetical investment scenarios from the perspective of their own

firm (Kenyon and Margalit 2012). By randomly assigning respondents to receive

different information about the investment conditions, such as whether or not

the potential host country participated in international trade and investment

treaties, it is possible to evaluate the causal impact of these agreements on

potential investors’ perceptions and assessments of the investment climate.

More

specifically, firm executives were presented with four vignettes containing the

description of “Country X,” which included a set of details about the

hypothetical investment destination (such as population size, rate of growth

and degree of political stability) that were held constant across all

respondents. However, all respondents were randomly assigned to receive one of

four different treatments, which varied in respect to the economic policy

actions the government of the country has taken. While all four treatments

included a government that is openly supportive of free market economic

policies, in only two of the scenarios the country was a member of

international trade and investment treaties. In addition, two of the treatments

referred to specific pro-market policies that the government had introduced.

In sum,

executives were presented with four potential investment scenarios differing as

follows:

1. The country

signed on to international treaties

2. The country

implemented pro-market reforms

3. The country

signed on to international treaties and implemented pro-market reforms

4. The country

has done neither

Respondents

were then asked to rate the business climate with a five-point scale: very bad

(1), bad (2), indifferent (3), good (4), and very good (5).

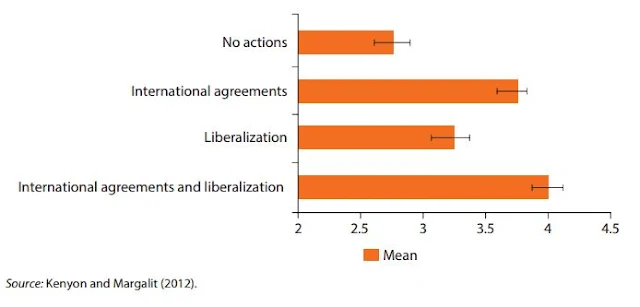

Kenyon and

Margalit (2012) examine the causal effect of the government’s decision to join international

trade and investment agreements on the attractiveness of the country to

potential foreign investors using a test of means of these ratings of the

investment climate. Their results show that, indeed, the combination of signing

onto international treaties and implementing pro-market reforms leads to the

most favorable assessment of the investment climate (3.95) (see figure 3.15).

Moreover, membership in international agreements is associated with a higher

rating (3.71) than only implementing liberal economic policies (3.28).

In sum, the

findings suggest that membership in international economic agreements does

indeed increase the perceived attractiveness of a developing country in the

eyes of potential investors. The comparison of means test, however, provides no

information as to the specific mechanisms through which trade and investment

agreements boost the attractiveness of host countries. Thus, Kenyon and

Margalit (2012) test empirically for the presence of possible mechanism that

may account for this effect, including the role of international treaties as

signaling mechanisms, their use as commitment devices constraining predatory

behavior by host governments, and their market-enhancing and cost-reducing

effects.

Chart Attribute: Perceived

Attractiveness of Investment Climate

Their analysis

finds strong support for the market-enhancing effects of international

agreements. In other words, firms appear to prefer investing in countries that

are members to trade and investment agreements because these treaties allow

firms to benefit from lower barriers of access to other countries’ markets and

to export back to the home country. Indeed, firms that described their main

motivation for investment abroad as either “to export back to the home country”

or “to benefit from a trade agreement” rated scenarios in which countries

signed onto international agreements more positively than other firms. This

large and positive association between trade motives and rating of investment

climates holds when controlling for sector of operation, home country and size

of the firm.

In contrast,

this study found little empirical evidence in support of the other three

possible mechanisms. The authors demonstrate that those firms that are most

concerned with the quality of the legal framework and the transparency of

business regulations in the host country do not assign a greater premium to

those countries that participate in international economic agreements than other

firms that have different concerns. Their analysis also fails to find any

evidence suggesting that firms with less mobile investments, which one would

expect to be more concerned about political risk, assign a higher rating to

host countries that are members of an international economic institution. Thus,

international treaties seem to have a limited impact in reducing developing

countries’ time-inconsistency and credible commitment problems.

Similarly,

Kenyon and Margalit (2012) find no evidence that participating in international

agreements contributes to increase investor confidence by signaling that the

country has a market-friendly orientation. Indeed, respondents gave the

hypothetical country that signed international economic agreements a more favorable

rating than they assigned to the two hypothetical scenarios in which the

government of the country made pro-market statements and implemented liberal

reforms. This suggests that signing onto a treaty has an independent effect

that goes beyond signaling a market-friendly orientation and policies. Finally,

the study found little empirical support for the cost-efficiency mechanism.

Contrary to what one would expect to observe if this mechanism was at play,

firms whose motives for investing abroad is efficiency of production do not

rate a country that participates in an international treaty more favorably than

firms who are less concerned about enhancing production efficiency.

Source: New Voices in Investment (2015) by The World Bank

This work is made

available by the Original Publisher – The World Bank, under the Creative

Commons Attribution 3.0 IGO license (CC BY 3.0 IGO) http://creativecommons.org/licenses/by/3.0/igo