By IndraStra Global Editorial Team

According to Morgan Stanley, the year 2023 is expected to be characterized by significant challenges to global economic growth due to various factors. These include heightened consumer demand following the COVID-19 pandemic, excessive retail inventories, and the persistent battle against inflation. As a result, it is projected that global GDP growth will reach a mere 2.2%, narrowly avoiding a recession but falling short of the anticipated 3% growth for 2022.

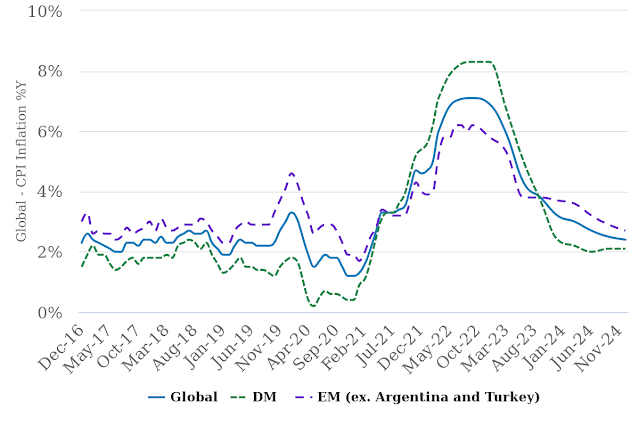

Nevertheless, there is a positive aspect to consider. Global inflation is predicted to reach its highest point during the fourth quarter of 2022. This is attributed to several factors, including a decline in demand, price reductions due to surplus inventories, and diminishing housing prices. These elements are expected to contribute to the moderation of inflationary pressures. Consequently, major central banks are anticipated to pause their activities and carefully evaluate their recent series of historically significant interest rate increases.

Several significant observations were drawn by Morgan Stanley's team of researchers regarding the global economy as we approach the year 2023:

- It is anticipated that the United States economy will experience a state of stagnation, characterized by a mere 0.5% growth rate.

- Economies across Europe and the United Kingdom are expected to undergo contraction, indicating a decline in their overall economic output.

- Emerging market economies are projected to exhibit a moderate recovery, suggesting a gradual improvement in their economic performance.

|

| Chart Attribute: Haver Analytics, Morgan Stanley Research forecasts |

Undoubtedly, the interaction between inflation and the intervention of central banks will ultimately determine the narrative surrounding economic growth in the year 2023.

Seth B. Carpenter, Chief Global Economist at Morgan Stanley, highlights that the Federal funds rate has experienced the most rapid increase since 1981, while the European Central Bank (ECB) rates have witnessed their swiftest rise since the establishment of the Eurozone. However, as supply chains for consumer goods recover and labor markets encounter fewer obstacles, it is possible to observe a more substantial and widespread decline in inflation. This could lead to a smoother policy trajectory and higher global growth.

Although our 2023 outlook does not contain many significant surprises, it does encompass various nuances. As expected, the economic landscape varies considerably by region. Western economies present predictable forecasts, whereas Asia, particularly India, could showcase positive signs of growth. Furthermore, emerging market economies may experience additional advantages as the Federal Reserve reaches its peak interest rate and the dollar's value decreases.

The United States

Considerable attention is currently focused on U.S. consumer prices, which have demonstrated a year-over-year increase of 8.2%. However, by the end of 2023, the year-over-year growth is expected to moderate to 2.4%.

The combination of decelerating economic growth and diminishing inflationary pressures will likely compel the Federal Reserve to curb its rate hikes. According to Ellen Zentner, Chief U.S. Economist, the target range is projected to reach its peak at 4.5% to 4.75% by January 2023. Subsequently, it is anticipated to remain at that level throughout 2023 and then gradually decline throughout 2024. This particular scenario suggests that the U.S. economy will experience a gentle slowdown and a modest recovery, deviating from the prevailing notion of a severe downturn and rapid rebound.

Furthermore, Zentner notes that although the Federal Reserve has been reducing its balance sheet by not replacing matured government bonds, such as treasuries and mortgage-backed securities, active sales are not anticipated. Selling mortgage-backed securities carries the risk of exacerbating the already declining housing market.

In terms of the labor market, Morgan Stanley predicts that despite companies slowing down hiring, there will be no significant workforce reductions due to lean payrolls and difficulties filling skilled positions. Net job gains have considerably slowed throughout the year, and coupled with a slight increase in labor force participation, this is expected to result in a marginally higher, yet still relatively healthy, unemployment rate of 4.3% towards the end of 2023.

|

| Chart Attribute: Bloomberg, Haver Analytics, Morgan Stanley Research forecasts |

The European Union and The United Kingdom

Morgan Stanley projects a contraction of 0.2% in the euro area economy for the year 2023, primarily influenced by the ongoing energy crisis and the tightening of monetary policy. Inflation, which reached an unprecedented annual rate of 10.7% in October 2022, is expected to remain significantly above the target level throughout 2022 and 2023.

Jens Eisenschmidt, Chief Europe Economist, asserts that due to concerns about inflation, the European Central Bank (ECB) will raise interest rates to 2.5% in the first quarter of 2023 before commencing rate cuts in early 2024. Morgan Stanley predicts a GDP growth rate of 0.9% for the euro region in 2024, which is lower than the consensus estimate of 1.6%.

On a positive note, the region's unemployment rate is at a record low of 6.6%. Employment and hours worked have surpassed levels seen in late 2019, and labor market participation is higher than it was before the energy crisis. Although labor markets may experience some weakening, any increase in unemployment is expected to be modest.

In contrast, the United Kingdom (U.K.) economy demonstrated growth of 7.5% and an estimated 4.2% in 2021 and 2022, respectively. However, due to double-digit inflation, the U.K. economy is anticipated to decline by -1.5% in 2023, representing the most significant economic deceleration among major economies, with the exception of Russia. Consequently, the Bank of England is likely to conclude its rate hikes at 4% and follow the Federal Reserve in implementing rate cuts in early 2024.

Bruna Skarica, Chief U.K. Economist, highlights that the persistent impact on real disposable income will continue to impede consumer spending as elevated economic uncertainty prompts individuals to maintain their savings. Additionally, a surge in mortgage rates is expected to lead to a sharp decline in sales of residential real estate.

China, Japan, and India

The outlook for Asia in the coming year appears favorable, with three of the world's largest economies playing a significant role in driving growth.

In the context of China, the revival of private consumption has the potential to drive a moderate economic recovery in the upcoming year. Robin Xing, Chief China Economist, anticipates a growth rate of 5% in 2023, with the majority of this growth expected to occur in the latter half of the year. This projection assumes that the economy will fully reopen after the repeal of Covid-zero policies early in the year. It is worth noting that this forecast represents a significant improvement compared to the estimated 3.2% growth in 2022. However, it is important to acknowledge that this growth rate marks a notable decline when compared to the average growth observed over the past decade.

In Japan, the presence of a highly developed economy and an aging population has contributed to relatively moderate growth even during favorable global macroeconomic conditions. In light of this, Morgan Stanley's projection of 1.2% GDP growth for 2023 is seen as a positive outcome, despite being lower than the consensus estimate. Takeshi Yamaguchi, Chief Japan Economist, emphasizes that households possess substantial surplus cash and deposits, which are expected to bolster growth in the coming year.

In the Indian context, the trajectory of GDP growth presents a distinctive pattern, with an expected expansion of 6.2% in 2023 and 6.4% in 2024. Notably, three significant megatrends, supported by the country's advanced digital infrastructure, are propelling India towards surpassing Japan and Germany, positioning it as the world's third-largest economy by 2027. Upasana Chachra, Chief India Economist, highlights that India possesses the necessary conditions for an economic upswing driven by offshoring activities, investments in manufacturing, and the transition towards renewable energy sources.

The positive prospects extend beyond the major economies in Asia. Numerous countries in the region are positioned for growth in the upcoming year, which could have favorable implications for the global economy as a whole. The swift normalization of economic activities in Asia can yield various benefits. It may stimulate European export demand, enhance supply chain operations, and counteract inflationary pressures. Furthermore, it could enable emerging markets to break free from the cycle largely influenced by the strength of the U.S. dollar.

COMMENTS