S&P Global Platts FACTBOX

April 1, 2020, New York — Crude prices climbed Tuesday as more producers announced production cuts, but remained near 18-year lows as the coronavirus pandemic continued to weaken demand.

Diamondback Energy said Tuesday it will further cut its spending and production outlooks as more oil producers take a second swipe at reductions within a single month amid a nearly unprecedented global demand collapse.

Fellow Permian operator Devon Energy said Monday it would cut its capital budget yet again, to $1 billion from $1.3 billion, including deferring all new activity in South Texas' Eagle Ford Shale. The cuts contributed to a $4.14 rally in the Platts Midland assessment to $14.23/b, pulling it from an all-time low $10.09/b reached Monday.

"Oil is potentially near a bottom and it will start to show further signs of life if oversupply concerns ease a little," said OANDA senior market analyst Edward Moya. "Until markets can start to understand how bad the demand shock will be since practically the whole world is on lockdown, most oil rallies will get faded."

The market remains glutted with crude as Saudi Arabia and Russia have yet to back off their plans to expand market share despite the drop in demand.

Gasoline and jet fuel crack spreads have been especially hard hit, with some turning negative as governments increasingly close businesses and schools, while airlines slash flights.

At least 32 US states and the District of Columbia have issued blanket "stay-at-home" orders, and partial orders are present in at least 12 other states, according to media reports. At least 265 million people are facing government requests that non-essential workers stay home.

According to S&P Global Platts Analytics, global oil demand is expected to decline around 4.5 million b/d in 2020.

The reduced upstream activity should materialize in lower production eventually. The current low-priced, $20/b crude environment is putting roughly 5 million b/d of high-cost crude production at risk of being shut in, according to Platts Analytics.

But in a worst-case scenario, if global demand falls by about 20 million b/d or more, a supply-demand gap of 24 million b/d could emerge, said Ethan Bellamy, an energy analyst with Robert W. Baird & Co.

PRICES

Oil

**West Texas Intermediate at Midland, Texas was assessed by S&P Global Platts at $14.23/b Tuesday, down $40.84/b from January 20, when commodities markets first began reacting to the virus.

**Crude futures have moved into steep contango, which should encourage storage increases, with the NYMEX front-month contract closing Tuesday at around a $15/b discount to the 12th-month contract.

**Western Canadian Select at Hardisty, Alberta was assessed at $10.87/b Tuesday, underscoring the struggle many of the country's producers will face surviving in the coming weeks and months.

**Atlantic Basin physical crude price differentials are weakening because of the refinery run cuts, with West African Djeno crude, for instance, assessed at a $5.60/b discount to Brent Tuesday, down from a $1.50/b discount March 2.

Jet

**The Singapore jet crack spread against Brent ended Tuesday at $2.83/b, up from minus 41 cents March 23, but down from $11.34/b January 20.

**The Rotterdam jet fuel crack against Brent ended Tuesday at $2.36/b, up from minus 54 cents March 23, but down from $14.17/b January 20.

**The New York Harbor jet crack against Brent ended Tuesday at 91 cents/b, down from $14.19/b January 20.

Gasoline/diesel

**The June NYMEX RBOB crack spread vs. ICE Brent ended Tuesday at around 75 cents/b, rising from minus $6.29/b March 23 as refiners have cut runs, but down from $11.78/b one month ago.

**The June NYMEX ULSD crack ended Tuesday at around $16.37/b, up from $12.14/b March 1, and holding up relative to RBOB on confidence that industrial demand would not suffer the same fate as driving demand.

TRADE FLOWS

Storage

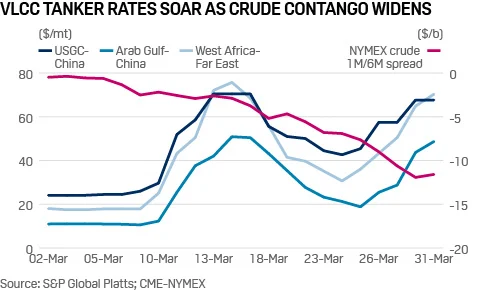

**With Saudi Arabia and Russia in a price war to flood the market with cheap crude, and refiners cutting runs on low demand, the crude contango has widened, encouraging global inventory builds.

**Almost 300 million barrels of commercial crude oil storage remains in the US, according to the latest estimates from federal data. But the US is still churning out close to 13 million b/d of crude oil. Those volumes are expected to decline, but not fast enough to prevent storage volumes from rapidly rising.

**Over the next few months, Platts Analytics sees global "massive" crude stock builds of 500 million barrels in its best-case scenario, compared with the 1 million-barrel build in its worst-case scenario, relative to end February levels.

**A record 11.1 million barrels of LOOP Sour Crude oil storage will be auctioned April 7, auction platform operator Matrix Markets announced Monday. During the monthly online auction, 11,100 capacity allocation contracts, spanning from front-month May through the third quarter of 2021, will be available to bidders.

**Market players in the dirty tanker sector are eyeing floating storage amid an oversupply of crude oil, giving freight rates a lift, with the USGC-China VLCC rate rising to $72.22/mt Thursday from $42.59/mt March 24.

**Saudi oil giant Saudi Aramco is moving a substantial amount of its crude to storage caverns in Rotterdam in the Netherlands and Sidi Kerir in Egypt. Around 800,000 b/d to 1 million b/d -- or 10%-15% -- of Saudi crude exports has recently traveled to Europe, with France, the Netherlands, Poland, Greece, and Spain making up the key demand hubs, according to S&P Global Platts estimates.

**A "supercontango" structure in the Singapore jet fuel swap spread has spurred sellers to take up floating storage in the region as land-based tanks become scarce. Shipping sources said this week that the latest ships reportedly taken for storage purposes were the STI Carnaby and the LR2 Eternity, chartered by Glencore, to be used as floating storage in Singapore for four months, with options to extend for another month at $44,000/day.

**The Trump administration will continue to urge Congress to appropriate $3 billion to fill the Strategic Petroleum Reserve with US crudes after lawmakers removed the plan from a coronavirus relief package, the Department of Energy said Thursday. DOE formally withdrew a solicitation to buy 30 million barrels of medium and heavy crudes a day after Republican leaders of the Senate agreed to take the measure out of stimulus legislation as part of a deal with Democrats to break an impasse.

Crude sales

**President Donald Trump is considering a plan which would significantly limit US refineries from importing foreign crude and instead process Bakken, Permian, and other domestic crudes, although the plan would include exceptions for refiners built to run grades unavailable in the US.

**China's crude oil imports from Saudi Arabia surged 25.8% on the year to 14.74 million mt or 1.8 million b/d in January-February, taking the supplier's market share to 17.1%, data from General Administration of Customs showed Wednesday. This was the highest market share for a single supplier since May 2015, when the kingdom grabbed 18%, GAC data showed.

**PetroVietnam aims to produce 10.62 million mt of crude in 2020, down 18.9% from 2019, and may further cut its production target as prices are too low and exports not profitable. Also, PetroVietnam's oil and gas exploration and production projects have been impacted by the coronavirus outbreak as many contractors are unable to send workers to the operation fields as planned.

**With refined products demand weak, several refiners in North Asia declined offers from Middle East producers for additional crude volumes to their allocated April term barrels, despite low oil prices. Japanese refiners are still mulling whether to increase crude oil purchases from Saudi Arabia and the UAE for May loading programs, after seeing no room for additional intake from the Middle East for April.

Aviation

**European airline capacity - Western, Central and Eastern - has fallen by 74% to 22.3 million seats from January 20 to 5.77 million Monday, OAG Schedules Analyzer data shows. While global capacity dropped below 50% Monday to below 50 million seats.

**European airlines are at the top of the table for making reductions in capacity this week with British Airways announcing the suspension of all flights out of London's Gatwick Airport Tuesday.

**Some of the world's biggest airlines are slashing their flights for the coming months, and jet fuel demand, which accounts for almost 8% of total oil demand, is taking an unprecedented hit.

**Middle East jet fuel/kerosene demand will fall by 125 kb/d, or 23%, year-on-year, to some 420,000 b/d in 2020, which would be the lowest in at least a decade, according to FGE Energy.

**Singapore Airlines Group said Monday it was cutting 96% of its capacity through the end of April in the wake of travel restrictions, while the UAE's Emirates, the world's biggest long-haul airline, will suspend most passenger flights as of March 25, operating mainly cargo.

**The International Airlines Group, which includes British Airways, Vueling and Iberia, plans to reduce capacity by at least 75% compared with April and May 2019.

Gasoline

**Mexican gasoline imports fell to their lowest level since June 2019 ahead of an expected drop in demand as the country prepares to stop activities in response to the coronavirus pandemic. Imports, which are mainly from the US, were 442,000 b/d the week ended March 21, according to weekly data from the Energy Ministry, down 23% from the previous week and 40.1% from two weeks ago.

**Pakistan's Ministry of Energy has asked its oil marketing companies to cancel planned imports of gasoline from April onwards, and its refineries to cancel crude oil imports, due to a fall in consumption as the country is under a coronavirus-triggered lockdown.

INFRASTRUCTURE

Upstream

**Top Permian Basin producers Pioneer Natural Resources and Parsley Energy formally requested Monday an emergency hearing seeking to implement mandatory crude oil production quotas in Texas. The Texas oil producers are asking the state's oil and gas regulatory body, called the Texas Railroad Commission, to use regulatory measures not utilized in nearly 50 years to tackle the "virtually unprecedented" global demand crunch.

**Global producers have announced spending cuts and reduced operations because of low prices, with the bulk of the cuts coming from North America.

**Diamondback Energy said Tuesday it will further cut back its spending and production outlooks as more oil producers take a second swipe at reductions within a single month amid a nearly unprecedented global demand collapse.

**European producers have joined in. Most recently, Shell trimmed Tuesday its estimated oil and gas production for the first quarter of 2020. Shell said it expects to report upstream production of between 2.65 million-2.72 million b/d of oil equivalent in the first quarter and between 920,000-970,000 boe/d of integrated gas for LNG.

**The cuts have begun to materialize in weekly rig activity. The US oil and natural gas rig count fell by 47 to 766 the week ending March 27, with 20 of those rigs coming from the Permian Basin, according to rig data provider Enverus.

**A plunge in prices has slashed the profit potential for oil production in Argentina, raising concerns that a cutback in investment could stymie the development of Vaca Muerta, its biggest shale play -- and one of the largest in the world. Pampa Energia, one of the biggest energy companies in Argentina, has postponed its drilling plans in Vaca Muerta.

**Peru's oil and gas producers urged the government to draft a bailout plan for the country's producers in the face of free-falling crude oil prices. The government needs to suspend royalties, taxes and all investment commitments for producers until July to avoid the shutdown of oil and gas fields, the Peruvian Hydrocarbon Society (SPH) said.

Downstream

**Global refineries have started to cut operations because of the low demand for transportation fuels. In the US, refiners are expected to cut runs by roughly 2.2 million b/d in April from January's 16.5 million b/d figure, according to Platts Analytics.

**Canadian refiners have joined in, with Newfoundland's 130,000 b/d Come by Chance refinery "transitioning to standby mode this week," a company spokeswoman said, while market sources said that Irving's 330,000 b/d refinery in Saint John, New Brunswick, were cut by 25%-30% as gasoline cracks turned negative.

**In Africa, South Africa's Engen refinery said it had opted for a "temporary controlled shutdown," while Chad's Ndjamena refinery in Djarmaya decided to halt operations because of overproduction.

**A number of refineries in Europe have reported cutting runs, including ExxonMobil's Gravenchon and Fos plants in France, and API's Falconara plant in Italy.

**Brazil's Petrobras is currently running refineries at about 74% of installed capacity compared with an average of 79% in 2019.

**Japan's gasoline demand is estimated at 764,921 b/d in March, down 8% from a year ago, and the lowest since 1990, according to data from the country's largest refiner JXTG Nippon Oil & Energy, and the Ministry of Economy, Trade, and Industry.

**Japanese refiners are considering cutting operating rates further in April - despite the rate in March falling to the typical turnaround level before the maintenance season has started.

**Refinery utilization rates have risen across China with state-owned oil giants raising run rates to around 70% of their combined nameplate capacity in March from a record low of 67% in February. Independent refineries in eastern Shandong province also lifted their average run rates to 60.3% as of March 25 from an average of 41.5% in February, according to local information provider JLC.

**Refiners in Vietnam have been forced to lower their production capacity. State-controlled PetroVietnam's Binh Son Refining and Petrochemical, or BSR, has cut the capacity of its 148,000 b/d refinery at Dung Quat to 105%, down from 108% before the end of February, an official from BSR said Tuesday.

About S&P Global Platts Analytics:

According to S&P Global Platts Analytics, global oil demand is expected to decline around 4.5 million b/d in 2020.

The reduced upstream activity should materialize in lower production eventually. The current low-priced, $20/b crude environment is putting roughly 5 million b/d of high-cost crude production at risk of being shut in, according to S&P Global Platts Analytics. Over the next few months, S&P Global Platts Analytics sees global "massive" crude stock builds of 500 million barrels in its best-case scenario, compared with the 1 billion-barrel build in its worst-case scenario, relative to end February levels.

IndraStra Global is now available on

Apple News, Google News, Flipboard, Feedburner, and Telegram