By Anqi Lei, Department of Government and Public Administration, University of Macau, China

By Anqi Lei

Department of Government and Public Administration, University of Macau, China

Image Attribute: Kangbashi, a subdivision of the Chinese city of Ordos, Inner Mongolia / Source: Wikimedia Commons

Image Attribute: Kangbashi, a subdivision of the Chinese city of Ordos, Inner Mongolia / Source: Wikimedia Commons

Real Estate Market Overinvestment

In order to motivate domestic real estate market, many Chinese banks took some measures to motivate their loan business, and real estate market became the target market. Most of these banks determine the amount and type of mortgage be obtained on the basis of the credit risk evaluation of counterparties. Collaterals are provided in the form of bills, loans or securities for reverse repurchase agreements, in the form of real estates and other assets for commercial loans, and in the form of residential properties for personal loans.

For instance, The ICBC “stepped up the support for residents buying a house for own use, drove personal mortgage loans using real estate development loans, and strengthened cooperation with large high-quality real estate intermediary agencies to promote new housing and secondhand housing loan business” ([1], Pg:58). By the end of 2008, loans secured by mortgages amounted to RMB 1,688,435 million, including RMB 597,374 million personal housing loans and representing an increase of RMB 168,687 million or 11.1% over 2007, which remained as the largest component of the total loans (Table 1).

Table 1: Distribution of loans by collaterals. Source: ICBC Annual Report, 2008 [1]

Quickly, the real estate loans in 2009 rose by RMB 95,137 million or 27.8%, principally when more and more developers and households start speculating in real estate market. And during the period between 2008 and 2010, the percentage of corporate real estate loans was always above 10% until 2011 when the property loans began to decrease quickly by RMB 7306 million or 1.4%, mainly because the Bank actively reduced the size of property loans in line with the changes in the real estate market (Chart 1). In fact, in 2011 many banks strengthened risk management of the real estate industry in response to the changes in relevant government policies which aimed to combat speculation in the housing market. Thus, banks adjusted their credit policy for the real estate industry in a timely fashion, revised relevant administrative measures and further improved the property loan system. Banks, like ICBC, even improved their customer entry standards and “adjusted the product mix of property loans to extend an active support to the construction of government-subsidized housing and further improve relevant policy for land reserve loans” [2]. These bank policies worked and since 2011, both corporate loans and non-performing ratio decreased obviously. By the end of 2014, the corporate loans only took up 6.6% of the total corporate loans among all industry.

However, one big problem is that the non-performing ratio increased quickly since 2014, and it increased from 6.6% in 2014 to 2.19% in 2016. As we can see in Table 2, the total loans and advances to customers increased since 2008 and suddenly dropped since 2011 due to government real estate control policy, but again, it climbed quickly since 2014 and peaked at RMB 642,423 million in 2016 which is the highest in the history. We can also see from the table that there was huge amount of overdue loans in real estate sector in 2015 and 2016 at RMB 17,653 million and RMB 22,288 million, respectively, which was around 4 times more than that in year 2011, and even higher than the climax of 2009. What’s more, loans that assessed to be impaired were amounted to as high as RMB 9556 million hence achieving the highest of the last ten years. All these data indicate that Chinese banks, represented by ICBC as the largest commercial state-owned bank in China, are and will face much severer default problem from real estate sector in the following years. And things for banks will become worse if China’s real estate market began to cycle from boom to burst. Unfortunately, the housing market in many cities has already been cooled down in recent years.

In China, out of their expectation, this form of financial repression policies caused large debt expansion and hot money in speculation industry, especially real estate market. On the one hand, low international interest rates have fueled debt through onshore banks. The International Monetary Fund (IMF) [5] finds that Chinese state-owned banks have served as intermediaries for corporate borrowing overseas through the provision of bank guarantees and letters of credit. The IMF notes: “Chinese firms have also taken advantage of low global interest rates through offshore bond issuance, which has increased substantially since 2010. Half of the debt issued abroad has been for operations in China. Since 2009, real estate developers have been the largest issuers of offshore bonds among nonfinancial firms.”

Chart 1: Corporate loans and non-performing corporate loans in real estate industry from 2008 to 2016. Source: ICBC Annual Report, 2008 -2016 [3].

However, one big problem is that the non-performing ratio increased quickly since 2014, and it increased from 6.6% in 2014 to 2.19% in 2016. As we can see in Table 2, the total loans and advances to customers increased since 2008 and suddenly dropped since 2011 due to government real estate control policy, but again, it climbed quickly since 2014 and peaked at RMB 642,423 million in 2016 which is the highest in the history. We can also see from the table that there was huge amount of overdue loans in real estate sector in 2015 and 2016 at RMB 17,653 million and RMB 22,288 million, respectively, which was around 4 times more than that in year 2011, and even higher than the climax of 2009. What’s more, loans that assessed to be impaired were amounted to as high as RMB 9556 million hence achieving the highest of the last ten years. All these data indicate that Chinese banks, represented by ICBC as the largest commercial state-owned bank in China, are and will face much severer default problem from real estate sector in the following years. And things for banks will become worse if China’s real estate market began to cycle from boom to burst. Unfortunately, the housing market in many cities has already been cooled down in recent years.

Table 2: Loans and advances to customers analysis in real estate sector from 2008 to 2016. [1] - [4]

Potential Debt Crisis

In China, out of their expectation, this form of financial repression policies caused large debt expansion and hot money in speculation industry, especially real estate market. On the one hand, low international interest rates have fueled debt through onshore banks. The International Monetary Fund (IMF) [5] finds that Chinese state-owned banks have served as intermediaries for corporate borrowing overseas through the provision of bank guarantees and letters of credit. The IMF notes: “Chinese firms have also taken advantage of low global interest rates through offshore bond issuance, which has increased substantially since 2010. Half of the debt issued abroad has been for operations in China. Since 2009, real estate developers have been the largest issuers of offshore bonds among nonfinancial firms.”

According to the statistics and calculation of a report from McKinsey Global Institute [6], non-financial corporations are most heavily indebted where real estate industry is a very significant part. As can be seen in Chart 1, the overall indebtedness of non-financial corporations increased dramatically from 72 trillion dollars in 2007 to 125 trillion dollars in 2014. At the same time, the debts of financial corporations and government also grew by a large amount since 2000, 828% and 139% respectively. According to Miriam’s calculation [7], “debt accumulation in areas such as real estate, shadow banking, provincial governments and SOEs has nearly quadrupled since 2007, rising to the US $28 trillion by mid-2014, up from US$7 trillion in 2007”. Data compiled by Bloomberg [8] shows that loans to companies and households.stood at a record 207% of gross domestic product at the end of June 2015 which was even higher than Greek debt (185% of GDP).

Chart 1. The composition of debt in China. Source: Dobbs et al., 2015 [6]

Chart 2 describes China’s debt situation compared with South Korea, Australia, United States, Germany and Canada in 2014. Among all these countries, China’s debt took up about 282 percent of GDP and listed number two, followed South Korea (286% of GDP), but is larger than that of the United States, Australia, Canada, and Germany. What’s more, among all the six counties and four debt sectors, China had the largest amount of non-financial corporation debts, which is around twice as much as that of the United States, Canada, and Germany. China also had the second largest amount of financial corporation debts, but least amount of household debts, only about half of that of the United States.

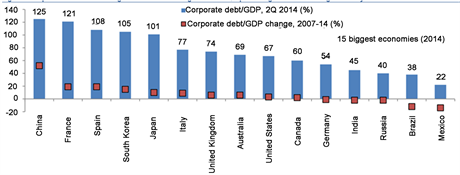

Chart 3 is about corporate debt in China in 2014 which shows that corporate debt in China has grown faster than in any other top-15 economy, and has become the highest in world’s large economies, implying a potential government contingent liability.

Thus, the evidence has already demonstrated a severe debt expansion problem in China, and these financial or non-financial companies and enterprises may default at any time as economic growth began to slow down and housing bubble began to burst in many cities. A Bloomberg article investigated the related debt environment and potential risk in China and pointed out that “Firms now take record 192 days to collect payment for their goods or services from when they pay for the inputs, according to data compiled by Bloomberg on non-financial corporations traded in Shanghai and Shenzhen. The cash conversion ratio is up from 125 days five years ago. Liquidity is tightening in China after company profits declined for the first time in three years and as debtors face their hardest time ever paying interest”. And the article quotes Iris Pang of Natixis “the longer the cash conversion cycle, the higher the risk of corporates not having enough cash to repay their debts” [9].

Chart 2: China’s debt compared with selected economies. Source: Dobbs et al., 2015 [6]

Chart 3 is about corporate debt in China in 2014 which shows that corporate debt in China has grown faster than in any other top-15 economy, and has become the highest in world’s large economies, implying a potential government contingent liability.

Chart 3: Corporate debt in China. Source: Business insider UK [11][12]

Thus, the evidence has already demonstrated a severe debt expansion problem in China, and these financial or non-financial companies and enterprises may default at any time as economic growth began to slow down and housing bubble began to burst in many cities. A Bloomberg article investigated the related debt environment and potential risk in China and pointed out that “Firms now take record 192 days to collect payment for their goods or services from when they pay for the inputs, according to data compiled by Bloomberg on non-financial corporations traded in Shanghai and Shenzhen. The cash conversion ratio is up from 125 days five years ago. Liquidity is tightening in China after company profits declined for the first time in three years and as debtors face their hardest time ever paying interest”. And the article quotes Iris Pang of Natixis “the longer the cash conversion cycle, the higher the risk of corporates not having enough cash to repay their debts” [9].

Real Estate Industry Default Cases in China

In China, debt exposure problems are just getting bigger. Many enterprises, especially real estate developers and related industries have been unable to pay their debts. Huas International Group, a famous real estate developer, was unable to pay their debts which involve more than 5 billion yuan [10]. Another big Chinese cement company, Shanshui Group, defaulted on two-billion-yuan ($314 million, £207 million) domestic payment [11][12]. What’s more, the state-owned Dongbei Special Steel Group Co. recently announced that it will not be able to get enough money to meet the RMB700 million debts [14]. All these default cases interpret a harbinger of bigger problems to come in China.

Huas International Group (Holdings) Company. Ltd

Huas International Group was established in 1993, and has become one of the most influential enterprises in the private economy of Hubei province, and also one of the top ten private enterprises in Hubei province. In 1996, the Group moved to the property market and mainly engaged in real estate development, commercial operations, hotel management, commercial trade, cinema studios, investment guarantees, financial securities, media advertising, property management, and other industries. Now the Group assets have reached six billion yuan.

On November 26, 2015, Wuhan Wealth Cornerstone Investment Management Co., Ltd which is one of the most influential management companies in Wuhan area, announced that its financial products cannot be honored. Huas International Group was just the real owner behind the Wuhan Wealth Cornerstone Investment Management. In 2015, Huas’ project was seized and cannot be sold so that the capital cannot be returned, which directly lead to this payment crisis. This payment crisis involves a total of more than 70 thousand investors and an amount of more than 5 billion yuan. Wuhan Wealth Cornerstone belongs to Cornerstone capital group (Huas international Group is the real one behind), and they use an online and offline dual track operating mode. Currently, there are more than 30 stores across the country, most of which are located in Wuhan city.

According to the Cornerstone online lending platform, we can find that this platform has been online for 483 days, the total amount of investment is one billion two hundred and fifty-eight million yuan, users total revenue is 19.9 million yuan, the total number of registered user are more than 75 thousand [10] [13].

Many industry insiders said that many real estate companies set up financial companies to input funds for their projects. However, those financial companies will be bankrupt once there is stagnation in sales and construction. The financial product which seems promising and profitable is actually highly risky.

Shandong Shanshui Default Case

Dragged by real estate industry, cement industry was hit by the dramatically decreasing demand. Real estate and infrastructure accounted for approximately 60% ~ 70% in the cement demand, so the increasingly murky situation in real estate industry has great negative effects on the cement industry. According to the data from the National Bureau of statistics, from January to April in 2015, the investment in Shandong’s real estate development grew by 0.6%, which decreased by 0.2 percentage points compared with the previous three months. Compared with the slow growth in investment, the fall of new projects of real estate is more severe. During the same period, Shandong new construction area of real estate fell by 30.5%. In the first 4 months of this year, Shandong cement production fell by 14.18%, to 4045.6 tons, while it was 4714.3 tons during the same period last year. Although the decreasing demand for cement, it is hard to further reduce the price because the low cost is also hard to reduce. The current cement prices are in the cost line. To reduce losses as far as possible, many companies have chosen to stop production. Now the operating rate of Shandong cement enterprises is about 60%, some are even lower than 50%, lower than the average level of 65% in previous years.

On November 11, Shanshui Group, as one of the biggest cement companies, has announced that it will not be able to get enough money to meet the domestic debts (Two-billion-yuan ultra-short financial bond) on or before November 12, 2014, and it will certainly face a debt default within the territory. Shanshui Group also announced that due to the economic slowdown and the decline of demand in cement market, coupled with overcapacity, China’s cement market competition continues to be intense, and there is a decline in both price and production [9].

Up to now, Shanshui Group still has six domestic bonds, and the total debts are 7.1 billion yuan, including the 20% debt default. These bonds will mature in the next two years, and the 2.6 billion yuan of ultrashort integration and medium-term notes need to be honored the first quarter of next year [11][12].

Huas International Group (Holdings) Company. Ltd

Huas International Group was established in 1993, and has become one of the most influential enterprises in the private economy of Hubei province, and also one of the top ten private enterprises in Hubei province. In 1996, the Group moved to the property market and mainly engaged in real estate development, commercial operations, hotel management, commercial trade, cinema studios, investment guarantees, financial securities, media advertising, property management, and other industries. Now the Group assets have reached six billion yuan.

On November 26, 2015, Wuhan Wealth Cornerstone Investment Management Co., Ltd which is one of the most influential management companies in Wuhan area, announced that its financial products cannot be honored. Huas International Group was just the real owner behind the Wuhan Wealth Cornerstone Investment Management. In 2015, Huas’ project was seized and cannot be sold so that the capital cannot be returned, which directly lead to this payment crisis. This payment crisis involves a total of more than 70 thousand investors and an amount of more than 5 billion yuan. Wuhan Wealth Cornerstone belongs to Cornerstone capital group (Huas international Group is the real one behind), and they use an online and offline dual track operating mode. Currently, there are more than 30 stores across the country, most of which are located in Wuhan city.

According to the Cornerstone online lending platform, we can find that this platform has been online for 483 days, the total amount of investment is one billion two hundred and fifty-eight million yuan, users total revenue is 19.9 million yuan, the total number of registered user are more than 75 thousand [10] [13].

Many industry insiders said that many real estate companies set up financial companies to input funds for their projects. However, those financial companies will be bankrupt once there is stagnation in sales and construction. The financial product which seems promising and profitable is actually highly risky.

Shandong Shanshui Default Case

Dragged by real estate industry, cement industry was hit by the dramatically decreasing demand. Real estate and infrastructure accounted for approximately 60% ~ 70% in the cement demand, so the increasingly murky situation in real estate industry has great negative effects on the cement industry. According to the data from the National Bureau of statistics, from January to April in 2015, the investment in Shandong’s real estate development grew by 0.6%, which decreased by 0.2 percentage points compared with the previous three months. Compared with the slow growth in investment, the fall of new projects of real estate is more severe. During the same period, Shandong new construction area of real estate fell by 30.5%. In the first 4 months of this year, Shandong cement production fell by 14.18%, to 4045.6 tons, while it was 4714.3 tons during the same period last year. Although the decreasing demand for cement, it is hard to further reduce the price because the low cost is also hard to reduce. The current cement prices are in the cost line. To reduce losses as far as possible, many companies have chosen to stop production. Now the operating rate of Shandong cement enterprises is about 60%, some are even lower than 50%, lower than the average level of 65% in previous years.

On November 11, Shanshui Group, as one of the biggest cement companies, has announced that it will not be able to get enough money to meet the domestic debts (Two-billion-yuan ultra-short financial bond) on or before November 12, 2014, and it will certainly face a debt default within the territory. Shanshui Group also announced that due to the economic slowdown and the decline of demand in cement market, coupled with overcapacity, China’s cement market competition continues to be intense, and there is a decline in both price and production [9].

Up to now, Shanshui Group still has six domestic bonds, and the total debts are 7.1 billion yuan, including the 20% debt default. These bonds will mature in the next two years, and the 2.6 billion yuan of ultrashort integration and medium-term notes need to be honored the first quarter of next year [11][12].

This is an excerpt taken from an original work by Anqi Lei, Department of Government and Public Administration, University of Macau, Macau, China. Views and opinions expressed in the adaptation are the sole responsibility of the author or authors of the adaptation and are not endorsed by Anqi Lei.

Cite this Article:

Lei, A. (2017) The Political Economy of Financial Repression Policy-Dominated China’s Overheated Housing Market. Chinese Studies, 6, 213-233. doi: 10.4236/chnstd.2017.64021.

References:

[1] ICBC (2008). Annual Report 2008, March 13.

[2] ICBC (2011). Annual Report 2011, March 15. Available from: http://www.icbc-ltd.com/icbcltd/investor%20relations/financial%20information/financial%20 reports/

[3] ICBC (2014). Annual Report 2014, March 26.

[4] ICBC (2016). Annual Report 2016, March 30. Available from: http://v.icbc.com.cn/userfiles/Resources/ICBCLTD/download/2016/7201520160422.pdf

[5] IMF (2013). Transition Challenges to Stability. Available from: http://www.imf.org/en/publications/gfsr/issues/2016/12/31/transition-challenges-to-stability

[6] Dobbs et al. (2015). Debt and (Not Much) Deleveraging. Finweek. http://www.mckinsey.com/global-themes/employment-and-growth/debt-and-not-much-deleveraging

[7] Campanella, M. L. (2016). Financial Repression and the Debt Build-up in China: Is There a Way Out? European Centre for International Political Economy. Available from: http://ecipe.org/app/uploads/2016/06/PB_05_2016_V3.pdf

[8] Bloomberg (2015). China’s Latest Default Foretold in Creditors Calling CFO Nonstop. https://www.bloomberg.com/news/articles/2015-11-11/china-s-shanshui-cement-to-default-on-onshore-bonds-on-thursday

[9] Bloomberg (2016). China Default Chain Reaction Looms Amid 192 Day Cash Turnaround.

[10] Sohu (2016) Reveal the Secret of the Bankruptcy of the Wealth Cornerstone and Other Wealth Management Companies for You. http://chihe.sohu.com/20160115/n434686335.shtml

[11] Moshinsky, B. (2015). Chinese Companies Are Starting to Default on Their Debt. Business Insider UK November 11. Available from: http://uk.businessinsider.com/chinese-shanshui-cement-corporate-default-2015-11

[12] Lopez, L. (2015). Chinese Companies Keep Giving Crazy Reasons for Losing Their Financial Records. Business Insider UK December 31. Available from: http://uk.businessinsider.com/chinese-company-records-taken-by-gang-2015-12

[13] Caixin (2016). Rash of Debt Defaults Should Spur Regulators to Act. http://english.caixin.com/2016-05-11/100942211.html

[14] Wodai (2015). Wuhan Cornerstone Was Reported Hard to Pay, 1000 Debt Collector Came down on the Company. http://www.wodai.com/n_zhuanlan/atrcle_71253.html

References:

[1] ICBC (2008). Annual Report 2008, March 13.

[2] ICBC (2011). Annual Report 2011, March 15. Available from: http://www.icbc-ltd.com/icbcltd/investor%20relations/financial%20information/financial%20 reports/

[3] ICBC (2014). Annual Report 2014, March 26.

[4] ICBC (2016). Annual Report 2016, March 30. Available from: http://v.icbc.com.cn/userfiles/Resources/ICBCLTD/download/2016/7201520160422.pdf

[5] IMF (2013). Transition Challenges to Stability. Available from: http://www.imf.org/en/publications/gfsr/issues/2016/12/31/transition-challenges-to-stability

[6] Dobbs et al. (2015). Debt and (Not Much) Deleveraging. Finweek. http://www.mckinsey.com/global-themes/employment-and-growth/debt-and-not-much-deleveraging

[7] Campanella, M. L. (2016). Financial Repression and the Debt Build-up in China: Is There a Way Out? European Centre for International Political Economy. Available from: http://ecipe.org/app/uploads/2016/06/PB_05_2016_V3.pdf

[8] Bloomberg (2015). China’s Latest Default Foretold in Creditors Calling CFO Nonstop. https://www.bloomberg.com/news/articles/2015-11-11/china-s-shanshui-cement-to-default-on-onshore-bonds-on-thursday

[9] Bloomberg (2016). China Default Chain Reaction Looms Amid 192 Day Cash Turnaround.

[10] Sohu (2016) Reveal the Secret of the Bankruptcy of the Wealth Cornerstone and Other Wealth Management Companies for You. http://chihe.sohu.com/20160115/n434686335.shtml

[11] Moshinsky, B. (2015). Chinese Companies Are Starting to Default on Their Debt. Business Insider UK November 11. Available from: http://uk.businessinsider.com/chinese-shanshui-cement-corporate-default-2015-11

[12] Lopez, L. (2015). Chinese Companies Keep Giving Crazy Reasons for Losing Their Financial Records. Business Insider UK December 31. Available from: http://uk.businessinsider.com/chinese-company-records-taken-by-gang-2015-12

[13] Caixin (2016). Rash of Debt Defaults Should Spur Regulators to Act. http://english.caixin.com/2016-05-11/100942211.html

[14] Wodai (2015). Wuhan Cornerstone Was Reported Hard to Pay, 1000 Debt Collector Came down on the Company. http://www.wodai.com/n_zhuanlan/atrcle_71253.html

![Chart 1. The composition of debt in China. Source: Dobbs et al., 2015 [2] Chart 1. The composition of debt in China. Source: Dobbs et al., 2015 [2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEggtFXomcZlc-r3XhMPLPdD729PZq-NtU29FoiWp-FhZubY6gKhVJnJ1YlV5Rr5Lvu5bmm_Yc1DpbwqtE5WFm_uvb_eih6E0HeAmFllfS-MlvcqqHLecfcPVBcpb6qi4buhFjz4FCcIPJxT/s640-rw/1-2550263x9.png)

![Chart 2: China’s debt compared with selected economies. Source: Dobbs et al., 2015 [2] Chart 2: China’s debt compared with selected economies. Source: Dobbs et al., 2015 [2]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEidp9umnHJkPESaxVdAmlUsWUW_sMFywUqIfJqRsZgKB1_xOd5HEIOtsAiR6mQxX9G1xaG99OeT4H4fPCO7RIJfP5rzYPZW4Gce2GaqI4NXkBnSzt_RAjxIKjW0ENUApj4Rq4TlguFUA0vm/s640-rw/1-2550263x10.png)