IndraStra Global Editorial Team

IndraStra Global Editorial Team

Image Attribute: Friends of MP Conclave 2018, Indore, MP, India / Source: IndraStra Global

Image Attribute: Friends of MP Conclave 2018, Indore, MP, India / Source: IndraStra Global

More than 300 participants descended to Indore from across the world and attended the "Friends of MP" conclave which was held from Jan 03-04, 2017. The conclave was set up on the lines of Pravasi Bhartiya Divas, keeping in mind, the Madhya Pradesh (MP)'s vibrant diaspora residing in other countries. This is all about going one-step ahead in "nation branding" by taking region-specific approach into direct consideration through the accumulation of diasporic capital or the conversion of other kinds of capital into diasporic capital.

The Concept of Diaspora Marketing

"The Friends of MP conclave is not an investment summit, rather it's a platform to unite the people of different professions, who belong to the state and have made their names in different fields in different parts of the world," - Shivraj Singh Chauhan, Chief Minister of Madhya Pradesh. (Source: Times of India / Jan 4, 2017)

Diasporas are groups living away from their birth countries such as first-generation immigrants. The idea is to market the cultural/geographical brand to a group that is familiar with and has an affinity for offerings that come from their home country. When that group provides a sales base, it gradually expands to people connected to the diaspora and finally to a broader market. This strategy avoids the often unfeasible attempt to build a brand on foreign shores from zero.

"Diaspora Marketing" as a concept has three categorical approaches, as suggested by Daniel Bell in his 1976 paper - technical-economic, political, and cultural approaches.

- Technical-economic approaches include studies from disciplines that concern themselves with conditions for economic growth, efficiency, and capital accumulation. These include marketing, management, and tourism studies.

- Political approaches include studies primarily interested in the impact of national images on nation-states’ participation in a global system of international relations. These studies come from the fields of international relations, public relations, and international communication.

- Cultural approaches include studies from the fields of media and cultural studies, which tend to focus on the implications of nation branding for national and cultural identities.

To attract investment from diaspora routes requires fine line segmentation. One attractive segment is the ethnic assimilators, those who prefer home country products. An even more attractive segment is the bi-cultural, those who not only will buy home country products but can help diffuse products into the host country. Then there are the assimilators, who prefer host country products and find cheap alternatives.

In deciding whether a diaspora strategy will work, several questions need to be posed:

- Is the diaspora large enough? It must have a critical mass, and in general, diaspora markets are substantial. Generally, their average income is often above the nation’s average. Additionally, many keep in contact with their homeland through travel and communication with relatives and friends.

- Is the diaspora distributed throughout the country? In addition to critical mass, they also need to be dispersed enough to support a breakout.

- Does the brand have an appeal that goes beyond the diaspora? Does it pave superior product performance, compelling value, and/or positive country-of-origin effects?

Madhya Pradesh as an "Investment Magnet"

The Government of Madhya Pradesh has been regularly conducting "Industry Interactive Sessions" for many years and they were being organized at several places in the country and abroad. Due to government's proactive initiatives and its incentive policies, a huge number of sectors are emerging with substantial potential for foreign investment. The investment climate in the state has grown remarkably to offer the best opportunities imaginable to an investor. According to the Department of Industrial Policy & Promotion (DIPP), cumulative FDI inflows, from April 2000 to June 2017, totaled to US$ 1.39 billion.

According to the Madhya Pradesh Vision 2018, in order to improve the ease of doing business for investors, an IT-enabled “Single Window System” is being created to enable a seamless flow of investors’ applications between administrative departments/agencies, to facilitate time-bound approvals. The ongoing aim is to simplify key business approval processes, including land allocation, water allocation, power supply connection, environmental clearances under city development plans, zoning laws, pollution control, construction and building permissions and disbursement of fiscal incentives. Also, the aim is to promote investments in manufacturing sectors such as food processing, textiles, engineering, electronic and hardware manufacturing by establishing various sector-specific industrial clusters across the state.

The List of Few Proactive Policies from Government of Madhya Pradesh:

The below-mentioned policies are covered under Madhya Pradesh Investment Facilitation Act 2008 and for the effective implementation, the state government has selected TRIFAC, an agency that encourages a single window system, for speedy approvals of different clearances and consents.

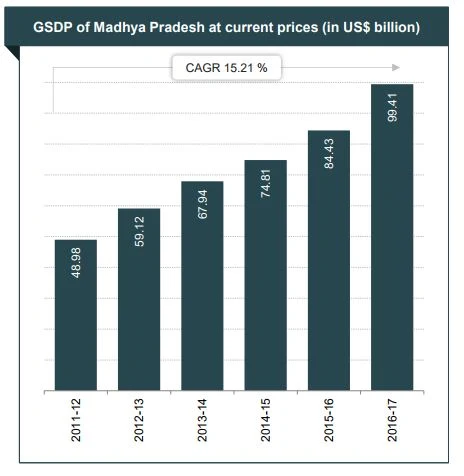

Madhya Pradesh's GSDP

At current prices, the gross state domestic product (GSDP) of Madhya Pradesh for 2016-17 stood at US$ 99.41 billion.

Between FY12 and FY17, GSDP of the state grew at a CAGR of 15.21%.

Note: US$ 1 = Rs 64.4273

Source: Advanced Estimates” provided by Directorate of Economics and Statistics, Government of Madhya Pradesh

Madhya Pradesh's NSDP

The net state domestic product (NSDP) of Madhya Pradesh was about US$ 88.77 billion in 2016-17.

Between FY12 and FY17, state’s NSDP grew at a CAGR of about 15.16%

Madhya Pradesh's Per Capita GSDP

The state’s per capita GSDP* in 2016-17 was US$ 1,261.89 in comparison with US$ 668.68 in 2005-06.

Per capita, GSDP in the state increased at a CAGR of 13.54% between FY12 and FY17.

Top five reforms implemented by Government of Madhya Pradesh

Source: Business Reforms Action Plan 2017, Department of Industrial Policy and Promotions, Ministry of Commerce and Industry, Government of India / EODB.DIPP.GOV.IN

According to the Madhya Pradesh Vision 2018, in order to improve the ease of doing business for investors, an IT-enabled “Single Window System” is being created to enable a seamless flow of investors’ applications between administrative departments/agencies, to facilitate time-bound approvals. The ongoing aim is to simplify key business approval processes, including land allocation, water allocation, power supply connection, environmental clearances under city development plans, zoning laws, pollution control, construction and building permissions and disbursement of fiscal incentives. Also, the aim is to promote investments in manufacturing sectors such as food processing, textiles, engineering, electronic and hardware manufacturing by establishing various sector-specific industrial clusters across the state.

The List of Few Proactive Policies from Government of Madhya Pradesh:

The below-mentioned policies are covered under Madhya Pradesh Investment Facilitation Act 2008 and for the effective implementation, the state government has selected TRIFAC, an agency that encourages a single window system, for speedy approvals of different clearances and consents.

- Industrial Promotion Policy, 2014 (Amended as of October 2017) - To improve investor facilitation and ensure rapid economic development and employment opportunities through the sustainable use of available resources. It also promotes SMEs and ensures PPP initiatives for industrialization.

- Analog Semiconductor Fabrication Investment Policy, 2015 - To increase the flow of investments in the field of electronics manufacturing in the state.

- Information Technology Investment Policy, 2014 - To facilitate the growth of the IT sector in the state.

- BPO Policy, 2014 - To boost the flow of investments in the BPO/BPM industry along with promoting the establishment of IT/ITeS units in the urban as well as rural areas in the state.

- Healthcare Investment Policy, 2012 - To facilitate the growth of healthcare services in the state.

- Warehousing And Logistics Policy, 2012 - To facilitate the growth of the logistics sector in the state.

- New & Renewable Energy Policy, 2012 - To facilitate the growth of the energy generation and distribution sector in the state.

- Defence Production Investment Promotion Policy - To facilitate the growth of the defense manufacturing sector in the state.

"Friends of MP": A Classic FIST (Fully Inclusive Stakeholder) Approach at Regional Level

In the book, "Nation Branding: Concepts, Issues, Practice" (Download the book), the author Keith Dinnies proposed - FIST approach a.k.a. Fully Inclusive Stakeholder, which provides a framework indicative of the range of potential stakeholders in the nation-brand. The same framework can be used for state-level branding activities.

The core of the FIST Approach is the government itself and is the only one which realistically aspires to coordinate all branding activities encompassing the full range of stakeholders.

The establishment of a coordinating body (by the government) is essential in order to avoid fragmentation and duplication of activity by the different stakeholders. but at the same time coordinating body also needs to possess a degree of political independence so that brand development strategy, which is a long-term undertaking, does not veer off-course every time a new minister is appointed or a new political party takes control of the government.

Public sector organizations are also one of the key components of the FIST approach. Such as tourism boards, inward investment agencies, economic development agencies etc., They work in close coordination with private sector organizations including various export promotion agencies to increase the marketability of particular nation or the region.

Under citizen's component, the diaspora of a nation or a region may be viewed as a preexisting network of potential brand ambassadors awaiting activation. If they are rightly activated, can act as crucial bridges between state policies and techno-managerial expertise driven by the local conditions of their homeland.

"...'Friends of MP' will work as brand ambassadors to promote the state across the globe while their expertise will be sought for development of the state..." - Shivraj Singh Chauhan, Chief Minister of Madhya Pradesh. (Source: Times of India / Jan 4, 2017)

Conclusion

"Friends of MP" like regional branding programs through the mobilization of diaspora under the tutelage of nation branding is thus becoming an area of growing importance for the governments, academics and strategic communications professionals alike. However, the process of integrating a marketing and communications strategies to the objectives and ambitions of policymakers may present serious challenges.

Firstly, it is important to understand that countries and there states – like brands – do not operate in a vacuum or in an isolation. They are often part of other national organizations or subgroups within organizations with several complementary or conflicting agendas. Therefore, the image and positioning of the state like Madhya Pradesh may be in constant shaping and different aspects of India's identity as a whole may be coming into focus on the international stage.

Secondly, governmental changes may often result in changes of the public and political agenda within a country or the state and this will impact upon such a politicized activity as a branding strategy development.

Thirdly, the legitimacy of those engaged in managing a state’s reputation is a key prerequisite to justifying – let alone embracing – practices of nation branding in the eyes of the country’s citizens. It is therefore incumbent upon the political leaders of the regional government who decide to engage in state branding activities to try to establish an overall national consensus and a long-term strategy that can be embraced by all key stakeholders, thus justifying the government's commitment.

________________________________________________

The Key Performance Indicators of Madhya Pradesh

Madhya Pradesh's GSDP

At current prices, the gross state domestic product (GSDP) of Madhya Pradesh for 2016-17 stood at US$ 99.41 billion.

Between FY12 and FY17, GSDP of the state grew at a CAGR of 15.21%.

Note: US$ 1 = Rs 64.4273

Source: Advanced Estimates” provided by Directorate of Economics and Statistics, Government of Madhya Pradesh

Madhya Pradesh's NSDP

The net state domestic product (NSDP) of Madhya Pradesh was about US$ 88.77 billion in 2016-17.

Between FY12 and FY17, state’s NSDP grew at a CAGR of about 15.16%

Note: US$ 1 = Rs 64.4273

Source: Advanced Estimates” provided by Directorate of Economics and Statistics, Government of Madhya Pradesh

Source: Advanced Estimates” provided by Directorate of Economics and Statistics, Government of Madhya Pradesh

Madhya Pradesh's Per Capita GSDP

The state’s per capita GSDP* in 2016-17 was US$ 1,261.89 in comparison with US$ 668.68 in 2005-06.

Per capita, GSDP in the state increased at a CAGR of 13.54% between FY12 and FY17.

Note: Per Capita GSDP^ - calculated using GSDP in million US$/population in million, Population estimated using NSDP and per capita NSDP figures provided by MOSPI

Madhya Pradesh's Per Capita NSDP

The state’s per capita NSDP* in 2016-17 was US$ 1,126.83 in

comparison with US$ 598.35 in 2011-12.

Per capita, NSDP of the state increased at a CAGR of 13.50%

between FY12 and FY1

Note: Per Capita NSDP^ - calculated using NSDP in million US$/population in million, Population estimated using NSDP and per capita NSDP figures provided by MOSPI

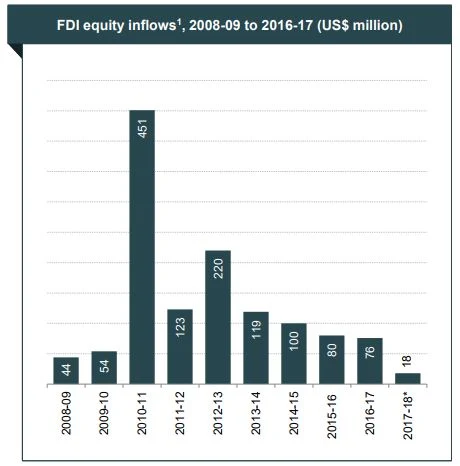

Madhya Pradesh's FDI Inflows and Investments

According to the Department of Industrial Policy & Promotion (DIPP), cumulative FDI inflows, from April 2000 to June 2017, totaled to US$ 1.39 billion.

Power generation & manufacturing were the key sectors which attracted the majority share of FDI inflow during 2014-15. In addition, the investments in real estate & services are also gaining momentum.

In 2014-15, exports from Madhya Pradesh reached US$ 4.19 billion in value terms, reflecting a CAGR of 8.4% between 2008-09 & 2014-15

With a capital investment of US$ 488.62 million, Government of Madhya Pradesh approved 6 projects in January 2017

Note: * As of June 2017

Source: Department Of Industrial Policy & Promotions (Including Chhattisgarh)

Top five reforms implemented by Government of Madhya Pradesh

Source: Business Reforms Action Plan 2017, Department of Industrial Policy and Promotions, Ministry of Commerce and Industry, Government of India / EODB.DIPP.GOV.IN