Global companies play a central role in the creation of value chains. Their strategic choices dictate the phases of production, localization of functions, the technological curve, technical standards and distribution conditions, and on this basis, job creation, investment and activity as well as national income.

By Michèle Rioux, Mathieu Ares and Ping Huang

Global

companies play a central role in the creation of value chains. Their strategic

choices dictate the phases of production, localization of functions, the

technological curve, technical standards and distribution conditions, and on

this basis, job creation, investment and activity as well as national income. A

global value chain describes all activities required to get a product or

service from its conception to its end use, and they are distributed

geographically (Sydor, 2011: p. 1). Based on their strategic dimension, we

often distinguish between two types of value chain models even though they are

not mutually exclusive. On the one hand, we find low technologically intensive

value chains based on cost control, in for example textile production. On the

other, we find the value chain focused on control of a particular technology,

as is the case in the electronics industry (OECD 2012: p. 8).

Looking at the

global value chain of Apple can help us better understand the transformation of

production and integration in North America. Due to the massive use of

electronic equipment for leisure and work, the size of the production sector of

electronic equipment now compares with the automotive industry. It is very

diverse, inasmuch as production of goods for consumers (telephones,

televisions, computers, etc.) represent just over half of the fabrication (53%

in 2008). It is also relatively well distributed geographically between Europe

(22% in 2008), North America (22%), Japan (15%), China (26%) and other

countries of Asia-Pacific (16%) (Decision Studies Council, 2009: pp. 5-6).

However, if the growing importance of Asia in the electronic value chain is

undeniable, the United States and Mexico occupy places among the fifteen

largest importers and exporters of electronic goods intermediaries, ranking 2nd

and 8th respectively in terms of imports and the third and 11th regarding

exports (Table 1).

Table 1 : Exports/Imports of ICT equipments, 2010 (millions US $)

Globally, the production of communication devices is one of the most fragmented industries, when the criterion used is the input from third countries in the production (OECD, 2012: p. 14). This may be partly due to the interconnectivity desired between different devices provided by multiple specialized suppliers as transport costs appear to be a secondary, given the size of goods and the high value derived from technology (OECD, 2012: p. 27). Typically, parent companies, responsible for research and development (R & D), finance and distribution are concentrated in developed countries, while developing countries specialize in different manufacturing stages, ranging from simple assembly to the manufacturing of strategic components.

Figure 1: Apple suppliers. Source: China file, based on

the Supplier List 2013 of Apple Inc.

According to

the list published in 2013[1] , nearly 750 providers are working with Apple. Asia

represented 86% of its global suppliers. Those are mainly in China where 331

sites exist, compared to 81 in North America and 46 Europe (Figure 1). There

are companies that specialize in the design and manufacture of electronic and

computer components, such as Samsung, LG, Sony, Qualcomm, but also those who

provide assembly services by contract, for example Foxconn.

The literature

points out the unequal capture of profit among firms in the Apple production

networks. Previous work has put emphasis on the imbalance of power between

Apple and its suppliers, particularly in the production line of mobile phones

(Kraemer et al., 2011). They use quantitative data grouped by supplier’s

country of origin to measure the difference in profit between the United States

and the rest of the production chain. In 2010, for the manufacture of an iPhone

4 with a retail price of US $549, the US accounted for US $321 or 58.5% of the

total price for the part of their work, primarily design and marketing, while

4.7% (US $26) went to South Korea for the display and memory, 2.4% (US $13) are

assigned to U.S. suppliers, 1.1% (US $6.5) associated with European

manufacturers and 0.5% (US $3) go to Japan. In terms of labor costs, an amount

of US $10 is paid to Chinese workers for the assembly.

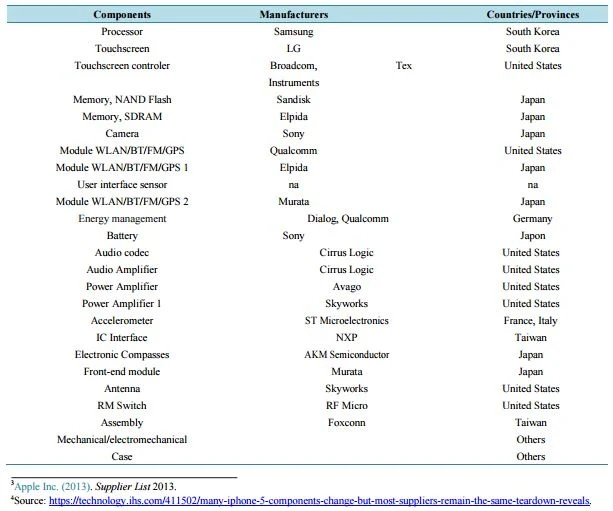

Table 2 : Main components of iPhone 5. Source: IHS iSuppli Research,

2012

With each new

iPhone release, analysts from IHS iSuppli Research conduct examinations of the

units. The panorama unveiled contrasts with the myth of “Made in China” since

the main part of the iPhone is not manufactured in China. For example, within

an iPhone 5 (2012), among the twenty-two main parts (processor, touchscreen,

memory, etc.), Japan and the United States are the two main countries of origin

of components. It is only through the intermediary of the Foxconn that the

participation of China appears (Table 2). We can thus summarize the production

of the iPhone in four steps:

1) Product design in the United States;

2) Purchase of components among US, Japanese, Korean and European suppliers;

3) Assembly of components at Foxconn factories in China;

4) Export of finished

products worldwide.

Most

researchers are looking at the factors that contribute to the success of Apple,

particularly its governance model of global value chains (Dedrick et al., 2008,

2011; Kraemer et al., 2011; Linden et al., 2011). Dedrick et al. (2008)

referred to the theory Profiting from Innovation developed by Teece (1986) who

links the ability of a company to profit from innovation to three main factors,

both internal and external: a dominant standard, an intellectual property

regime[3] and complementary assets. They conclude that the main reason Apple’s

iPod family gets a bigger profit, compared to notebook PC models of Lenovo and

Hewlett-Packard (HP), lies in the exclusive control exercised by the company on

software constituting the heart of the infrastructure of these products, as

well as standards and materials. This exclusive tacit knowledge of industrial

design and user interfaces also allows the company to reduce the possibility of

imitation by competitors. Apple’s innovations have been developed within the

system. This approach differs from that adopted by other companies in the

sector which continue to follow the structure established by Wintel (Windows

and Intel). Apple has put in place arrangements to secure the system of

complementary assets such as an exclusive distribution network (Apple stores),

the platform for the sale of music and video online (iTunes store), and

patented accessories. With the existence of a closed production structure,

Apple is a powerful customer, which has the ability to influence the market and

suppliers. The high level of profits is a result of a power relation

benefitting Apple, insofar as Apple may require its suppliers a low price level

or switch to another provider that best meets their needs. Yet, Froud et al.

(2014) describe an “apparent paradox between the misery of the assembler and

the richness of the brand” (p.54) at the earth of Apple’s financialization (…)

model. The authors analyzed the different positions of Fox conn and Apple

through the value chain. The results show the company struggling to make a

profit despite the low cost of its workforce. On Apple’s side, the firm has

managed to increase its revenue by a factor of 5 from 2005 to 2010.

According to the

authors, the situation which China (and its companies) faces today is different

from the 1980s and 1990s when Japanese and Korean companies suffered less

influence from Western companies. Relationships between Foxconn and Apple are

considered similar to those of a subcontractor of the apparel sector that only

performs activities “cut, make, trim” (Froud et al., 2012: p. 20). Haslam et

al. (2013) add that Apple contracts make up towards 50% of Foxconn’s revenues.

This strong dependence makes Foxconn more vulnerable than other suppliers, such

as Samsung which has a very different relationship with Apple. This means that

Apple value chain power is diverse and evolving power relations exists between

Apple and other actors in its production networks.

About The Authors:

Michèle Rioux - Département

de science politique, Université du Québec à Montréal, Montreal, Canada

Mathieu Ares - École

de politique appliquée, Université de Sherbrooke, Sherbrooke, Canada

Ping Huang - Center

for Research on Integration and Globalization, Montreal, Canada

Endnotes:

[1] Apple Inc. (2013). Supplier

List 2013.

[2] Source: https://technology.ihs.com/411502/many-iphone-5-components-change-but-most-suppliers-remain-the-same-teardown-reveals.

[3] See Pisano & Teece (2007). Proprietary

regimes include the strategic aspects which can limit competition in a

technology segment and protect firm profits, such as intellectual property

rights and industry standards organizations.

This article is an excerpt from a research paper, titled "Beyond NAFTA with Three

Countries: The Impact of Global Value Chains on an Outdated Trade Agreement" published at Open Journal

of Political Science, 2015, 5, 264-276 Published Online July 2015 in SciRes.

http://www.scirp.org/journal/ojps http://dx.doi.org/10.4236/ojps.2015.54028

Download The Paper - LINK

Copyright ©

2015 by authors and Scientific Research Publishing Inc.

This work is licensed

under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/